Archived Insight | November 15, 2017

Should Investors Get More Out of Bank Loan Portfolios as Rates Rise?

By Don Sheridan

Interest rates have been rising in the U.S., which, in theory, should be a good thing for bank loan strategies’ performance. Since 2016, the U.S. Federal Reserve has increased the Fed Funds Policy Rate by 25 basis points at four separate meetings, and the Fed has set a trajectory for further rate hikes in the near future.

Floating rate bank loans are near-zero duration instruments with coupons that reset every 90 days or so depending on the reference variable London Interbank Overnight Rate (LIBOR) to which a loan facility is underwritten. Using the 90 day LIBOR is common for bank loans and is a close proxy to the Fed Funds Rate. Today, the 90 day LIBOR is hovering around 1.25%, which is twice what it was at the end of 2015.

So with short rates finally moving higher and 1% LIBOR floors now behind us (this is the interest rate level stated in a number of leveraged loan covenants beyond which the coupon is allowed to float), isn’t now the time to reap the benefits of a bank loan strategy investment?

Well, yes and no.

Bank Loan Strategies Trail High Yield Bonds, Even as Rates Rise

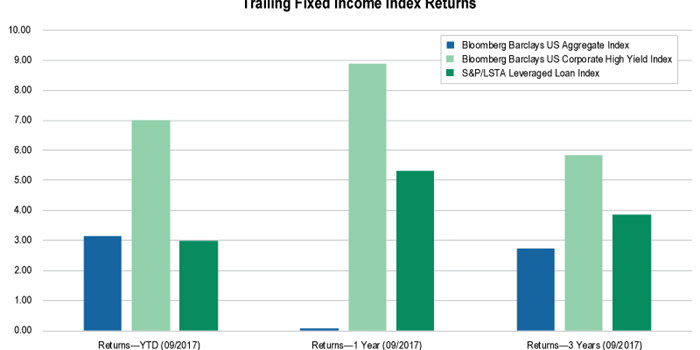

2017 has been a strange market for fixed income investors. Year to date, most spread sectors have outperformed the Treasury market, but loans are nearly even with the Treasury-heavy Bloomberg Barclays U.S. Aggregate Index, a benchmark currently exhibiting a 0.85 correlation to 10 year Treasuries (floating rate bank loans have a -0.46 correlation), as shown in the graph below.

Yes, interest rates are going up, and the Fed hiked them at both its March and June 2017 meetings. However, macroeconomic headwinds, subdued inflation, and an insatiable demand for liquid U.S. fixed income has given the U.S. Aggregate Index the ability to perform better than many would have expected coming into the year.

As you can also see from the chart, high yield bonds have soundly outperformed loans in both the year to date and 3 year periods. High yield has performed well due to a low default environment and a supportive domestic economic backdrop. The less efficient CCC and lower segment of the high yield market has rallied significantly since early 2016. (CCCs were up 30% that year alone!)

The CCC and lower sector footprint of the S&P LSTA Leveraged Loan Index is a little more than 4% vs. 17% for the Bloomberg Barclays High Yield Index. While this allows loans to be a higher quality asset class relative to bonds, it also means that high yield bonds have more potential upside when lower quality credits outperform to such a degree.

Another hindrance to upside market capture when high yield beta is rallying is that loans are callable instruments at par. High yield bonds, on the other hand, are frequently issued with call protection, allowing investors to experience price appreciation beyond par as well as any benefits derived from the duration and credit spread features.

One last noteworthy mention regarding loans’ relative performance of late rests with their popularity. Investors have anticipated rising rates for a few years now, so they have bought up loan strategies. Aided by positive net flows, total net assets in 40-Act Mutual Fund bank loan strategies since 2015 are more than $11 billion. This phenomenon naturally pushes down the potential for price appreciation from individual loans as the index moves closer to par.

When high yield loans are in demand, there is potential for an unfavorable dynamic to exist between spread compression and gross yields (coupons) coming from the increase in LIBOR. If spreads tighten too quickly due to investor demand not being offset by new issue supply (around 70% of year to date issuance has been through the refinancing channel), this “technical” could offset the floating coupon benefit a lender hopes to receive through rising rates.

Things Are Still Looking Up for Bank Loans

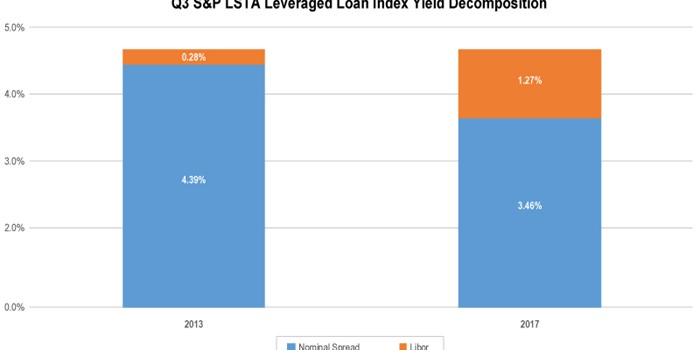

Bank loan investors can still take heart for a few reasons. First, bank loan yields have remained relatively stable, despite spread compression in the sector. By analyzing the decomposition of the yield since 2010 for the S&P LSTA Leveraged Loan Index, the following conclusions can be made today regarding the excess spread over LIBOR (nominal spread):

- Spread compression has begun to decelerate

- Spread compression has not been meaningful enough to pull down the gross yield below the 2010-2016 average coupon of 4.60% for a prolonged period of time

Also, it wouldn’t take much for senior secured loans to close the performance gap against bonds in the near future because of the volatility profile found in bank loans (3 year annualized standard deviation of 2.85% for loans vs. twice that for high yield bonds) as high yield bond spreads are now trading inside of bank loan spreads.

Even though the upside market capture has been limited for high yield loans vs. bonds, the rally in the lower credit quality market has been a major contributor to this dispersion. If the CCC and lower sector has overshot fair valuation, then the high yield bond market will suffer to a greater degree than loans given their footprint and inferior position in the capital stack when credit falls out of favor and defaults suddenly tick up. In today’s market, an investment in bank loans is trading upside capture for downside protection.

Lastly, with a U.S. economy still on solid ground, bank loans continue to be attractive credit-sensitive investments. With a low current default rate and outlook, the credit risk premium, or nominal spread, at 3.46% is arguably still attractive by historic measures (the average is around 3%).

Bank Loans: Still Quietly Appealing Right Now

High yield bank loans allow investors to have senior secured credit exposure, compelling yields relative to other asset classes, strong efficiency metrics (i.e. Sharpe Ratios), and floating rate benefits. When scaled appropriately, the asset class continues to offer a low correlation to equities and Treasuries, can serve as an inflation-hedging strategy behind strong real economic growth, and offers a way for investors to benefit from improving corporate sector growth.

Bank loans remain an attractive piece of a well-diversified fixed income allocation, even if performance in the most recent rising rate environment has been muted when compared to other fixed rate bond strategies.

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.