Archived Insight | December 13, 2018

How Might Quantitative Tightening Affect Markets?

- The Federal Reserve has embarked on quantitative tightening (QT) to reverse years of quantitative easing (QE) aimed at stimulating the economy after the Global Financial Crisis (GFC)

- As global growth starts to slow, it is difficult to predict how and how much QT will affect markets

- This is uncharted territory for the Fed and for markets—policymakers will need to tread carefully as this process moves forward

After years of post-financial crisis QE, the U.S. Federal Reserve (Fed) is reversing the process with QT. But what will this mean for the economy, particularly in an era of slowing global growth

What is Quantitative Tightening?

As a way to stimulate the U.S. economy after the 2008 financial crisis, the U.S. Federal Reserve introduced its QE program. With QE, the Fed bought up securities, such as government bonds, to increase liquidity, and the new money in turn swelled the size of bank reserves in the economy.

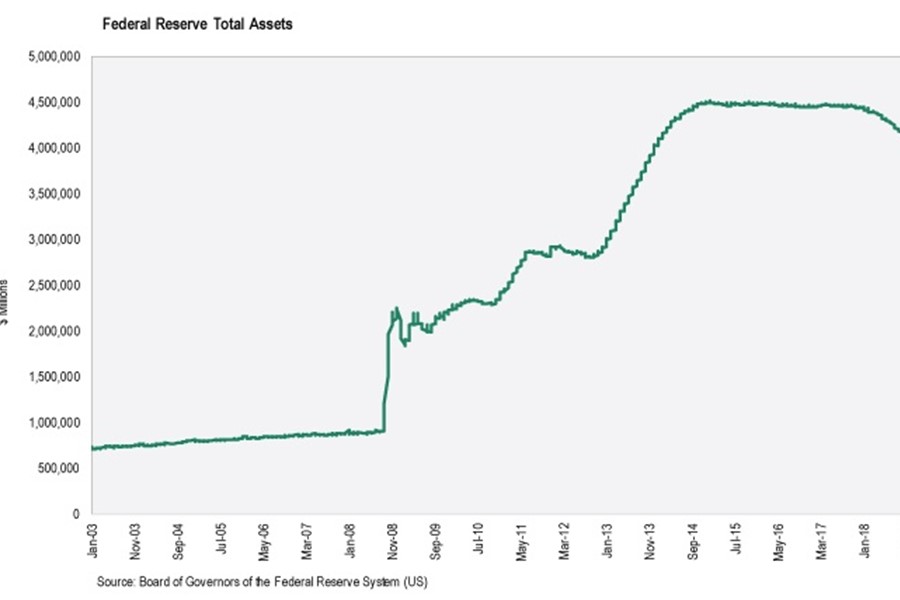

During its QE program, the Fed’s balance sheet grew from less than $1 trillion in 2007 to more than $4.5 trillion in 2018. Along with buying bonds, the Fed lowered short-term interest rates nearly to zero.

With rates at rock-bottom levels and bank reserves up, the idea was that banks would be in strong shape to lend and people would be incentivized to borrow money, thus stimulating the economy.

With this fiscal stimulus in the economy, investors moved money into riskier assets, which caused stock prices to rise. Indeed, the GFC was followed by a nearly 10-year bull market for stocks, the second longest in U.S. history.

Now, after almost a decade and massive growth in its balance sheet, the Fed is trying to normalize its monetary policy with the QT – the opposite of QE.

Instead of buying bonds and driving down interest rates, QT means that the Fed plans to raise rates and reduce its balance sheet back down closer to its pre-crisis level.

In October 2017, the Fed began the process of shrinking its balance sheet by allowing securities that mature to simply roll off without reinvesting in the proceeds. At the end of November 2018, the Fed’s assets stood at around $4.1T.

In addition to cutting down its balance sheet, the Fed is also incrementally raising short-term interest rates from near zero after the GFC. Short rates have increased since late 2015 and have reached a range of 2% to 2.25%, which is still well below long-term norms.

The Fed plans to continue hiking rates in the near term as long as economic and employment data remain solid.

How Might Quantitative Tightening Affect Markets?

The Fed is implementing QT as a way to slowly bring monetary policy back to normal and to have room to stimulate the economy if it falls back into recession.

However, QT comes with multiple risks for the economy and markets.

First, it will be a challenge for the Fed to control the timing of tightening. If it tightens too fast, it could slow the economy and cause a recession. If it waits too long, though, inflation may shoot higher and the economy could overheat.

Boosting interest rates increases the cost of borrowing; therefore, less money will be borrowed for spending and investments and people are likely to save more instead. This in turn may slow down growth in the economy.

QT could lead to greater market volatility if investors do not anticipate the Fed’s moves. Also, since QT is basically the opposite of QE, winners in the easing era will be losers as the Fed continues to tighten the balance sheet.

This could be bad news for the stock market and emerging markets because of the strengthening of the dollar.

It’s not just the Fed that is starting to tighten—other central banks have discussed reversing their easy monetary policies as well. The European Central Bank (ECB) said in June it planned to tighten in tandem with the Fed and has begun to scale back its asset purchases as a first step in tightening.

The Bank of England (BoE) plans to wind down its asset purchase program, which it also began after the GFC. The Bank of Japan (BoJ) has implemented QE since the 1990s to try to boost the Japanese economy. The BoJ has not yet begun tightening but has expressed its desire to do so.

But just as central banks are starting to pull away the so-called “punch bowl,” global growth seems to be turning lower. Growth in the Eurozone in particular has shown meaningful signs of declining, which could have negative effects on emerging markets.

Even in the U.S., there are signs that this economic cycle may be slowing. This means that there could actually be a limit to how much global QT will actually happen.

Some of the fears about QT in the U.S. may be counterbalanced by a global growth slowdown in the near term. Inflation is one issue that may be affected by economics as much as by tightening. As the U.S. economy continues to be on relatively solid ground, inflation has picked up recently.

It could go even higher in the near term as the Fed hikes rates, particularly if the U.S. economy remains stable and unemployment remains low. However, as the outlook for growth in the U.S. and globally starts to dim, it is possible that inflation in the U.S. will be dampened.

The Federal Open Market Committee (FOMC) of the Fed may reevaluate the pace of hiking if growth shows it is meaningfully declining.

Further, some investors worry about the impact of QT on the so-called “term premium” on Treasuries, or the premium for holding long Treasuries instead of short duration Treasuries. QT’s effects could cut either way: the impact of increased supply of Treasuries in the market could lead to an “increase” in term premium.

Or, investors might get anxious about tightening and favor shorter-duration Treasuries, making longer yields rise and term premium decline. And, if QT leads to a recession, then term premium will likely disappear because the yield curve will likely flatten or invert (where the short end of the curve is steeper than the long end).

But, once again, in reality, bond performance is affected by investors’ feelings about the economy as well as by effects of QT.

Market volatility has also picked up some in 2018, but markets so far have not been rocked as much by Fed tightening as they have by changing views on global economic growth, earnings and nervousness around trade policy.

We are in uncharted territory here, and the results of this gigantic shift in assets will be difficult to predict as it unfolds. Policymakers will need to tread carefully to make this change from easing to tightening at a time when growth prospects in the U.S. and worldwide seem to be softening.

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.