Archived Insight | February 9, 2018

Recent Market Swings: Volatility is Back

The U.S. stock market’s performance swings since last Friday, February 2, show that volatility had not disappeared from the market at all – it was hiding.

Investors in U.S. stocks have enjoyed unprecedented low volatility in the last year or so. The Chicago Board Options Exchange (CBOE) Volatility Index, more commonly known as the VIX, which is the measure of market volatility nicknamed “the fear index,” fell to historic lows in 2017. But all that market calm was shattered February 2, when the Dow Jones Industrial Average fell 666 points, a 2.5% drop and at that point, the largest decline since June 2016.

Since then, stocks have been on rocky ground, diving another 4.6% on Monday, their steepest decline since August 2011, while gaining 2.3% on Tuesday in a late-session recovery and falling again on Thursday by 4.2%.

What Put the Fear Back in the Fear Index?

Somewhat ironically, it was investors’ reaction to more good news in the U.S. economy – and what that could mean for inflation and bonds – that caused some of the turmoil. Interest rates and inflation have been low during much of the recent bull market. The strong jobs report last week showed wage growth rising, and this evidence of continued economic strength made investors fear that inflation would finally pick up in a meaningful way, and as a result, interest rates would rise more rapidly.

The yield on the 10-year Treasury rose to 2.84% by the close on February 2, (from 2.40% at the end of 2017) before dropping back to 2.77% by February 6 and then bouncing back up to 2.86% on February 8. Beyond fears of rising rates, political turmoil likely added to the market woes, with nervousness surrounding the budget impasse, the various election probes and statements from the administration on the markets creating more uncertainty.

Do Investors Have Reason to Fear the Recent Stock Market Decline?

At times like this, it’s important for investors to remember that the standard deviation of equity returns has two tails. There is the one that goes up, which is the tail that U.S. stock investors have been enjoying for much of the last few years, particularly with monetary stimulus from the Federal Reserve after the Global Financial Crisis. However, there is also the other, the negative tail of volatility, which investors have felt in the last few days.

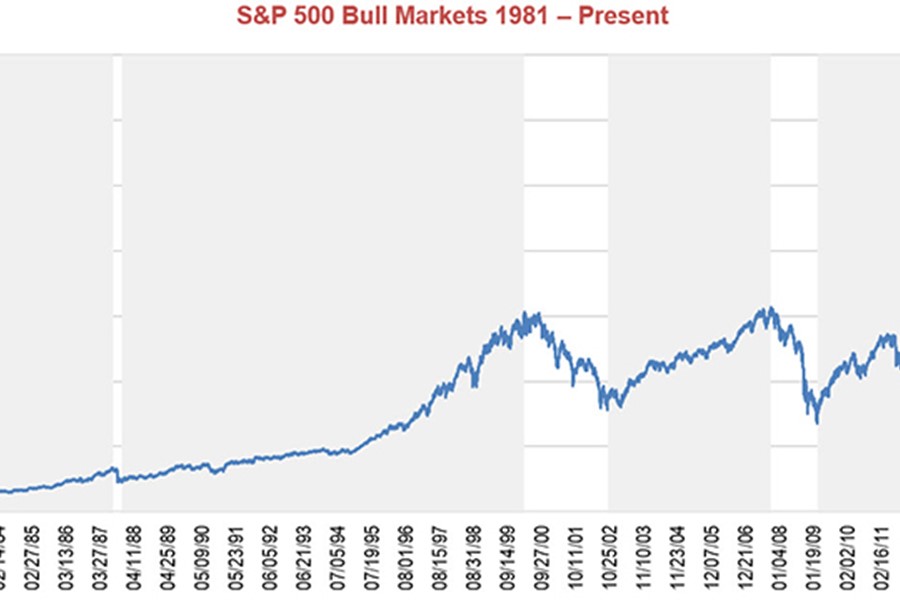

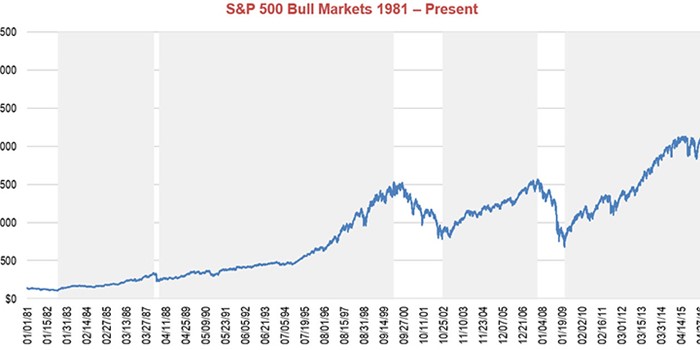

The most recent bear market ended/bull market began March 2009. The current bull market is the second longest on record, with the 1987-2000 period being the longest. The market was up approximately 325% from start of recent bull market period, March 9, 2009, to a peak on January 26, 2018.

The bull market has been particularly strong in the last couple of years. The S&P 500 Index had risen 14 straight months by the end of 2017 (plus another positive month in January). This string of positive months was a first in the index’s 90 plus year history.

But there have been some recent performance downturns that many investors may have forgotten, like the double-digit decline in early 2016 when energy prices fell, and another big decline after the Brexit vote in June 2016. These downturns were followed by more gains, and the index ended the year up 12%, but this is a great reminder that downturns are more frequent than we sometimes recognize.

The good news for investors is that, despite this recent correction in stocks, many of the underlying market fundamentals still look strong. Corporate earnings remain solid and the recently passed tax reform legislation may mean companies have more capital to invest in their businesses and increase earnings growth. The economy is still running above 2%, which, while isn’t gangbusters growth, continues to be steady, with unemployment remaining low.

While the risk of recession may be rising, it does not seem to be imminent in the near term given the fundamentals. In addition, global economic growth has become synchronous, with strength in both the Eurozone and in many emerging markets around the world. While all of this good news may mean that rates will continue to rise, it also shows that the backdrop for stocks remains relatively positive. It is likewise important to note that the 30 Year Treasury yield, even after the recent rise, is still about where it was close to one year ago – prior to the very favorable equity market rise in 2017.

If Volatility is Here to Stay, What Should Investors Do?

All of this means that most stock investors would do well to hang on during this suddenly bumpy ride. Noting, of course, that each investor’s circumstances are different and their specific risk tolerances, time horizon, liquidity and objectives must be considered. Stock sector volatility and increased equity valuations point to underlying volatility that is ever present (but not unusual or historic). Volatility may be back for good, given investors’ possible increased sensitivity to news and political events. If that’s the case, we should be ready for continued ups and downs in the future.

Discipline is even more important when the underlying risks are tougher to see – and discipline helps investors remember that investing in the markets always carries risks. Rebalancing, reviewing policy allocations, understanding the benefits of diversification, keeping track of cash flows, and other consistent best practices help give investors comfort during times of unforeseen volatility or market declines.

Segal Marco Advisors provides consulting advice on asset allocation, investment strategy, manager searches, performance measurement and related issues. The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. Segal Marco Advisors’ R2 Blog and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. Please contact Segal Marco Advisors or another qualified investment professional for advice regarding the evaluation of any specific information, opinion, advice, or other content. Of course, on all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.