Archived Insight | March 28, 2018

Volatile Markets: An Opportunity for Active Managers to Earn Their Keep?

By Ben Hall

During February, it was difficult to miss coverage of the downward trend in equity markets, which accelerated into a slump at the beginning of the month. This marked the end of an extended period of soaring markets, where the Dow Jones Industrial Average had climbed without a correction since early 2016. Such a fall may have been a jolt to many investors, but it could be an environment for active managers to outperform.

What Has the VIX Indicated About the Market Environment?

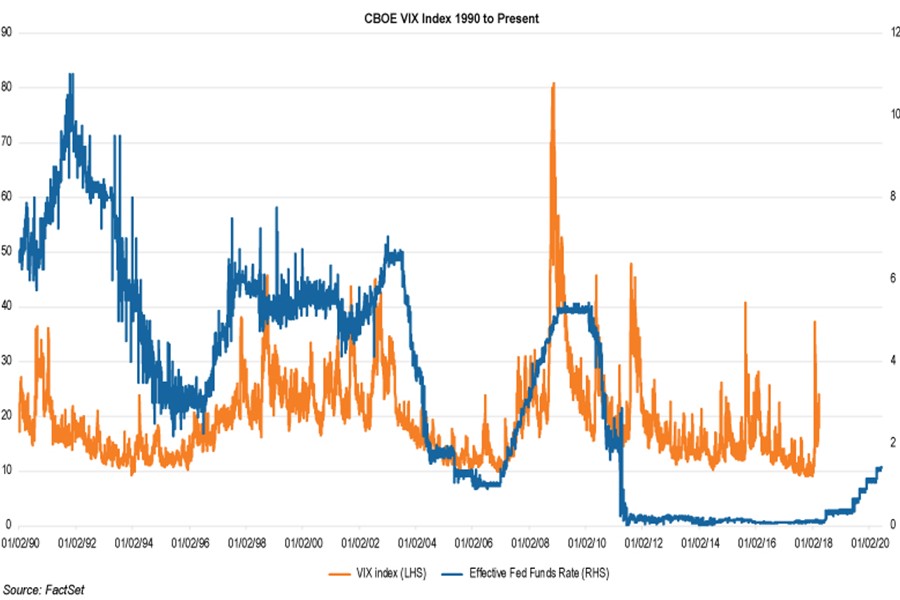

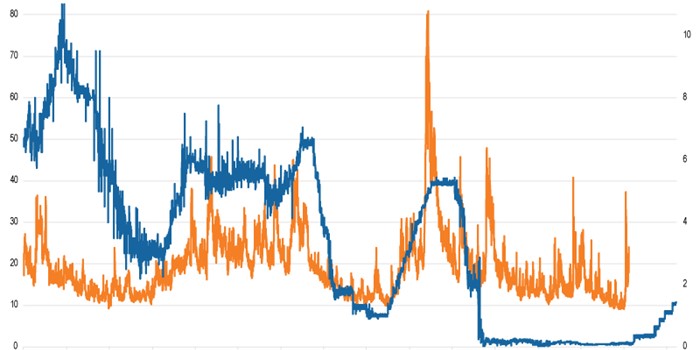

The catalyst for much of the volatility is somewhat ironically the realization that the U.S. economy is doing better than many had expected (which prompted fears of increased inflation). This has led investment managers to review their forward-looking expectations for rising interest rates, as the extended period of low interest rates may be approaching an end.

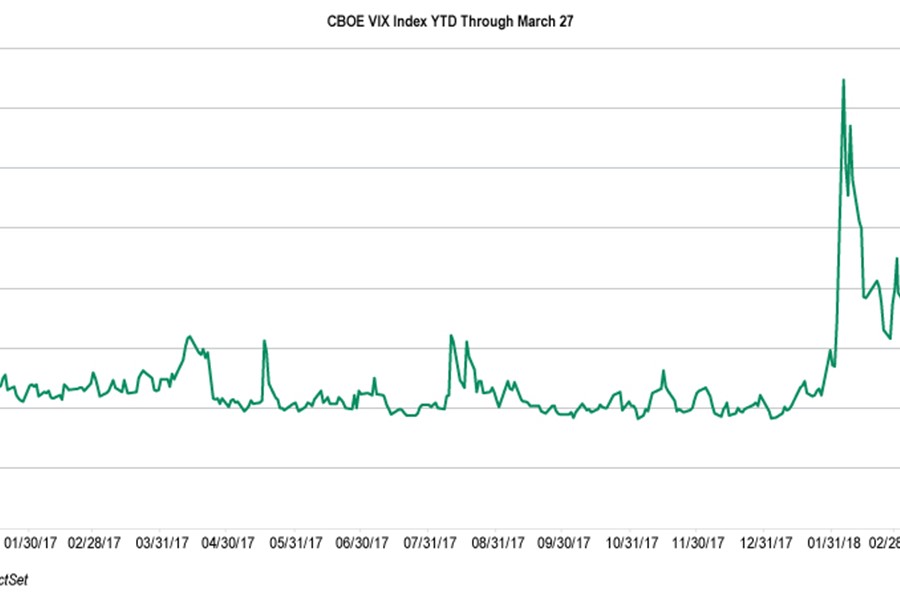

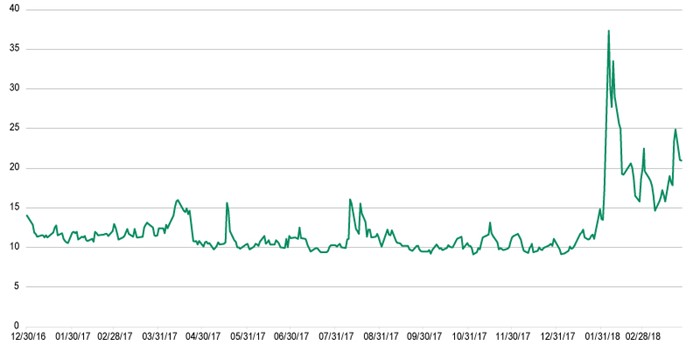

At the beginning of February, the Chicago Board Options Exchange’s Volatility Index, or “VIX”, skyrocketed from below 15 to just above 50 in a matter of a few days, which was a tremendous change in investor sentiment from recent history. A reading above 30 on the VIX indicates a high level of uncertainty in the markets. (In 2017, the VIX did not rise above 16)

The VIX was designed to be a forecasting tool for investors’ expectations of volatility. However, throughout 2017, above average correlations among all primary equity peer groups and an increased concentration among FAANG[1] and other tech stocks in the S&P 500 has moderated overall market volatility to historically low levels. Given this scenario and U.S. stock valuations that are well above long-term averages, risk in the U.S. stock market became relatively easier for investors to ignore.

Indeed, February’s spike in the VIX came as a surprise to many investors who had become used to a calm U.S. stock market that was steadily climbing higher with few major downturns. However, in a rising rate environment, volatility in markets does often pick up. While there can be a lag between the time when rates start rising and when volatility picks up, it is often the case that a rate hike cycle is followed by higher levels of volatility.

How Can Investors Structure Their Equity Portfolios to Weather Periods of High Volatility? Diversification is Key.

In response to volatility’s visit, we remind investors of the importance of diversification in investment portfolios, whether it be by country exposure, size, or investment style. While the markets have rewarded the largest, fastest growing companies in recent years, a period of increased volatility and/or market pullback might favor strategies that focus more on valuation and quality of cashflow generation than pure top-line growth.

Historically, heightened volatility has tended to favor more defensive sectors, which typically have larger weights in value benchmarks.

Many small cap companies also have different sensitivity to interest rates than large cap companies due to their ability to generate growth to the bottom line of their income statement. This is because small cap companies have more opportunity to create exponential secular growth, for example, a biotech firm that gains FDA approval for a new class of drug. Combining both small and large caps in a diversified portfolio of U.S. equities should produce a smoother set of returns than a portfolio that is skewed to a particular capitalization.

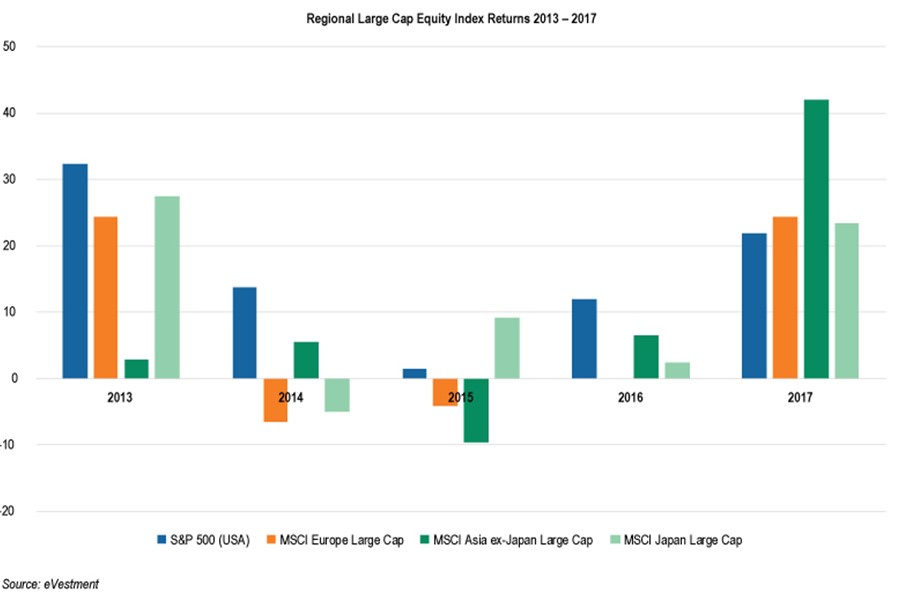

In addition, we emphasize the importance of global diversification. In a previous blog post, we noted that following the global financial crisis (GFC) the U.S. underwent the longest period of economic expansion since World War II. Those investors with a strong bias to domestic equities have reaped the rewards of this period of growth through strong returns in their equity portfolios.

In contrast, the economic recovery in Europe was somewhat muted until 2017 when the MSCI Europe Large Cap index returned 24.4% compared to the S&P 500 index’s 21.8% return. While there is an argument that many of the largest companies in the U.S. have a global revenue base, these companies’ stock prices are still heavily correlated with U.S. markets. To gain the true benefits of diversification, investors might consider opportunities among overseas listed companies.

Is the Active vs. Passive Debate Entering a New Phase?

Finally, we have seen several chapters in the ongoing debate between active management and passive management, with a strong case being made for passive management over recent years. However, we highlight that the recent environment of low volatility and upward trend has been a ‘goldilocks’ environment not only for the global economy, but also for passive management, as many of the largest companies have been the fastest growing in terms of their market capitalization. Over many market cycles, the one constant has been a general reversion to the mean, and cap weighted passive management is not well equipped to take advantage of mean reversion.

Periods of heightened volatility present an opportunity for active investment managers to demonstrate their worth, as they attempt to identify the “[investment] wheat from the chaff” by using detailed fundamental or quantitative analysis of stocks to build more optimal portfolios than a pure market capitalization weighted portfolio. More dispersion among equities within peer groups could provide more opportunities for active investors, even during more correlated markets.

Although U.S. equity markets were highly correlated overall in 2017, there was notable dispersion or variability of returns across sectors (as measured by the magnitude of return difference between the best and worst performers). While this may not always be the case, often the greater the dispersion, the greater the opportunity to achieve returns above the index.

As always, Segal Marco Advisors will be watching active managers closely for evidence that they are implementing their investment strategies effectively in order to deliver superior returns for investors over the long-term. In any market environment, a well-diversified portfolio that includes both growth and value stocks, as well as U.S. and international exposure, may help investors weather any volatility upturns that could be on the way.

Segal Marco Advisors provides consulting advice on asset allocation, investment strategy, manager searches, performance measurement and related issues. The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. Segal Marco Advisors’ R2 Blog and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. Please contact Segal Marco Advisors or another qualified investment professional for advice regarding the evaluation of any specific information, opinion, advice, or other content. Of course, on all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.

[1] Facebook, Amazon, Apple, Netflix and Google

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.