The month of April was a rollercoaster. The April 2 “Liberation Day” tariff announcement escalated trade tensions, sending global capital markets down in an unusually correlated sell-off of stocks, bonds and the U.S. dollar. Despite the sell-off early in the month, by month’s end the U.S. equity market recovered to under 1 percent down, with bonds slightly positive.

Macroeconomic indicators were mixed in the month. March’s CPI monthly decrease of 0.1 percent came in lower than expected, due principally to lower fuel prices and travel-related costs associated with tariff-affected international demand. Annual inflation slid to 2.4 percent, the lowest since September 2024, and within the range of the Fed target of 2.0 percent. The Fed’s preferred measure of inflation, core PCE, was lower than expected at roughly zero, although it does not yet reflect the full tariff impact on consumption. However, the ISM Manufacturing PMI survey results weakened further to 48.7 (below 50 indicates economic contraction) with sub-sectors such as production, imports and new export orders significantly lower from the prior month. The Conference Board Consumer Confidence Index survey indicators tumbled further for a fifth consecutive month, with the Expectations Index component declining to its lowest level in thirteen years. The U.S. dollar declined 4.6 percent, one of the largest monthly retreats since 2009.

| Equity | YTD (%) | MTD (%) |

|---|---|---|

| All Cap U.S. Stocks |

|

|

| Russell 3000 | -5.4 | -0.7 |

| Growth | -8.4 | 1.7 |

| Value | -1.5 | -3.1 |

| Large Cap U.S. Stocks |

|

|

| S&P 500® | -4.9 | -0.7 |

|

Russell 1000 |

-5.1 | -0.6 |

| Growth | -8.4 | 1.8 |

| Value | -1 | -3 |

|

Mid Cap U.S. Stocks |

|

|

|

S&P 400 |

-8.2 | -2.3 |

|

Russell Midcap |

-4.4 | -1 |

| Growth | -4 | 3.4 |

| Value | -4.5 | -2.5 |

| Small Cap U.S. Stocks |

|

|

| S&P 600 | -12.7 | -4.2 |

| Russell 2000 | -11.6 | -2.3 |

| Growth | -11.7 | -0.6 |

| Value | -11.4 | -4 |

| International |

|

|

| MSCI EAFE NR (USD) | 11.8 | 4.6 |

| MSCI EAFE NR (LOC) | 2.8 | -0.1 |

| MSCI EM NR (USD) | 4.3 | 1.3 |

| MSCI EM NR (LOC) | 2.4 | -0.2 |

| Fixed Income | YTD (%) | MTD (%) |

|---|---|---|

| Bloomberg |

|

|

| U.S. Aggregate | 3.2 | 0.4 |

| U.S. Treasury: 1-3 Year | 2.5 | 0.8 |

| U.S. Treasury | 3.6 | 0.6 |

| U.S. Treasury Long | 3.5 | -1.1 |

| U.S. TIPS | 4.3 | 0.1 |

| U.S. Credit: 1-3 Year | 2.3 | 0.6 |

| U.S. Intermediate Credit | 3 | 0.7 |

| U.S. Credit | 2.4 | 0.1 |

| U.S. Intermediate G/C | 3.4 | 0.9 |

| U.S. Govt/Credit | 3.1 | 0.4 |

| U.S. Govt/Credit Long | 2.4 | -1.2 |

| U.S. MBS | 3.4 | 0.3 |

| U.S. Corp High Yield | 1 | 0 |

| Global Aggregate (USD) | 5.7 | 2.9 |

| Emerging Markets (USD) | 2.3 | 0 |

| Morningstar/LSTA |

|

|

| Leveraged Loan | 0.4 | -0.1 |

| Alternative | YTD (%) | MTD (%) |

|---|---|---|

| Bloomberg Commodity | 3.6 | -4.8 |

| S&P GSCI | -4 | -8.4 |

Equity markets

Early April featured the CBOE Volatility Index (VIX) (often called the fear gauge) hitting a level of 60 (a value of 20 is considered normal) that was last seen during the 2008 global financial crisis and March 2020 pandemic. The S&P 500 index experienced one of its worst historical cumulative two-day declines of -10.5 percent from April 3-4, before a rally took hold, and it closed the month down only -0.7 percent. However, the sell-off was broad-based, with 335 companies in the index posting negative returns. On a sector basis for the month, Energy (-13.6 percent) and Healthcare (-3.7 percent) fared worse, while Information Technology (+1.6 percent) and Consumer Staples (+1.2 percent) were the top contributors. In the U.S., Growth (R3000G +1.7 percent) finally exceeded Value (R3000V –3.1 percent) on a monthly basis for the first time in 2025. On a year-to-date basis, all portions of U.S. markets are negative, with the small cap S&P 600 as the worst-performing segment. It is worth noting that the expected blended year-over-year corporate earnings growth rate for all S&P companies in Q1 is 10.1 percent, which is below the 5-year average of 11.3 percent but above the 10-year average of 8.9 percent.

International equity markets, including both Developed (EAFE +4.6 percent) and Emerging Regions (EM +1.3 percent), were positive and again outperformed the U.S. (S&P 500 -0.7 percent). Valuation spreads, a weakening U.S. dollar and potential impact of tariffs on U.S. equities were tailwinds. In the developed markets during the first quarter, the Pacific (+5.0 percent) outperformed on a regional basis with outsized returns in Australia (6.8 percent), while in emerging markets, Latin America (7.0 percent) outperformed on a regional basis with a surge in Mexico (13.0 percent); China lagged at -4.2 percent. For the quarter, consumer staples was the strongest performing sector abroad.

Fixed income:

Fixed income returns were generally positive in the month and the Bloomberg U.S. Aggregate index returned 0.4 percent (3.2 percent year to date), providing positive diversification to the negative equity environment. International fixed income has outperformed the U.S., with the Global Aggregate at 5.7 percent year to date.

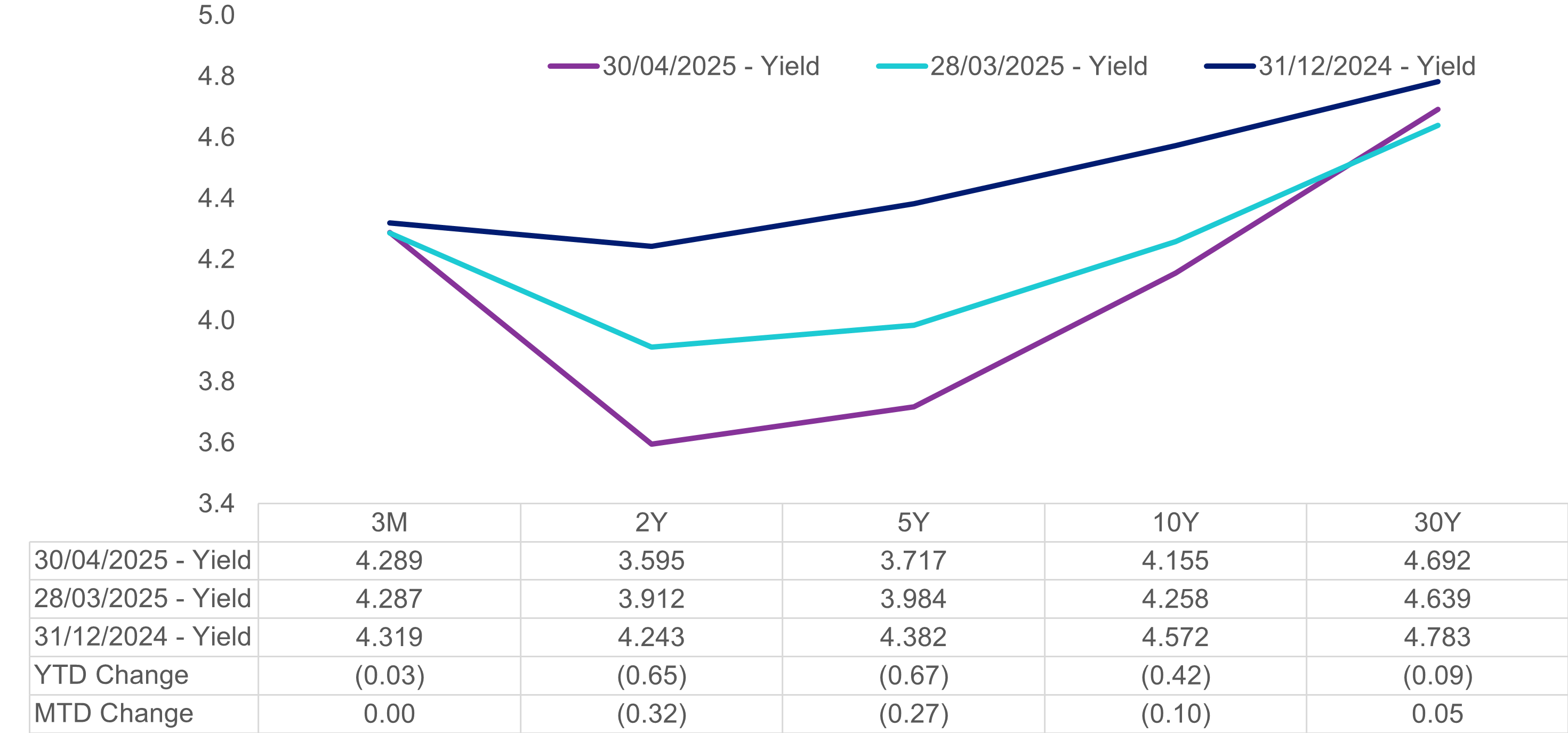

Looking at the yield curve below, April month-end interest rates (the green line) steepened at the short to mid-end area and increased at the longer end. From the start of the year the downward trend on interest rates continued, as yields dropped the most at 3-year maturities, which fell 69 basis points. The 10-year Treasury is back to 4.2 percent but experienced a sharp move down to 4.01 percent on April 4 before surging upwards to 4.48 percent on April 11.

U.S. Treasury Yield Curve

Source: FactSet

Looking ahead

Ongoing uncertainty regarding the federal government's trade and domestic policies will continue to pose challenges for the capital markets. So far this year, the markets have experienced a stock decline and rally, downward U.S. dollar currency exchange rates, a surge in gold, lower oil prices, volatile interest rates and a reappearance of negative interest rates in Switzerland as global investors seek shelter. Amid the volatility, we continue to advise clients to remain focused on aspects of their portfolio such as asset allocation, rebalancing as appropriate and maintaining sufficient reserves to meet upcoming benefit needs.

See more insights

February 2025 Financial Markets

March 2025 Financial Markets

Q4 2024 Investment Market Update

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.