Archived Insight | September 27, 2017

How Did Hurricanes Harvey and Irma Affect U.S. Markets?

While Hurricane Irma was raging across the Caribbean and bearing down on Florida, she conjured up images of the widespread devastation the Gulf coast experienced following Hurricanes Harvey and Katrina. Many were worried that Irma could cause an even greater amount of damage.

Investors were concerned the U.S. economy would take a major hit from Irma. The VIX, the volatility index known as the “Fear Gauge,” spiked. Energy stocks braced for another hit, already hurt by Harvey, who shut down a full 25% of U.S. oil production and 60% of U.S. ethylene production capabilities. Investors then gravitated toward safer assets like gold and prepared to weather both the impending hurricane and the storm about to hit the stock market.

Did the Power of Harvey and Irma Derail the Current Bull Market?

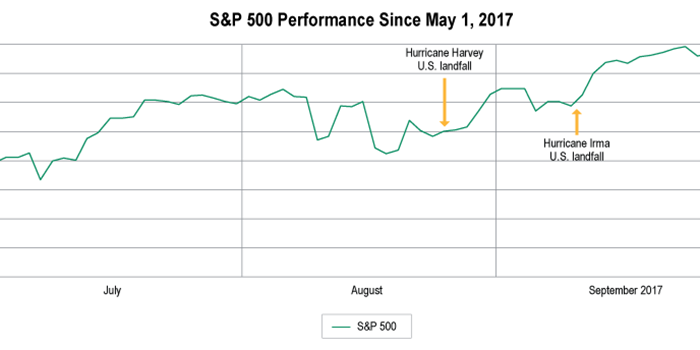

Irma’s last minute shift to the west spared the major cities on Florida’s east coast from the Category 5, head-on disaster everyone feared. The stock market largely discounted Irma’s potential toll. In fact, the S&P 500 actually rose on Monday, September 11, the day after the hurricane’s two destructive Florida landfalls, by 108 bps overall as damage estimates began coming in below $50 billion (those estimates have since risen).

Despite investors’ reaction, Florida’s agricultural commodities and its hospitality industry have taken a hit, and widespread power outages have affected individuals and businesses, significantly lowering the state’s economic output.

Investors evidently do not think there will be a lasting negative impact from Harvey and Irma. By September 11, the S&P 500 Energy Index had already rebounded, and insurers rallied when loss estimates came in lower than expected at $19 billion.

New York Fed President William Dudley said that construction wages will rise, as labor markets are already tight, and that several economic sectors may experience growth after the storms. "The long-run effect of these disasters unfortunately is it actually lifts economic activity because you have to rebuild all the things that have been damaged by the storms,” Dudley told CNBC.

Investors quickly began to unwind their safety hedges. The VIX saw its biggest intraday decline in 3 weeks, the U.S. dollar rose for the first time in 8 days, and gold fell 1.2% as investor’s confidence returned. By late Monday, the ratio of rising stocks to falling stocks was at a 3 month high.

Damage estimates from Harvey are currently between $65 billion and $190 billion, which means that if it ends up at the top of that range, it would be the most expensive hurricane in recent history. Irma’s damages are estimated to be between $50 billion and $100 billion, also putting it near the top of the list.

Nevertheless, stock market losses from the two hurricanes were relatively minimal, and certainly were lower than market reactions after other storms. Just as investors have largely disregarded all kinds of bad news lately, not even the terrifying power of Harvey and Irma could derail the current bull market.

All of this discussion of markets and hurricane devastation tends to ignore the real human toll of these storms for many. More than anything, these terrible events claimed lives and left serious damage for those who lived through them. The Segal Group has set up a way for employees to donate to hurricane victims and we are thinking of everyone affected by these storms.

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.