Archived Insight | May 30, 2018

FAANG 2018 Update: More Volatile and Less Cohesive

Highlights:

- Five high-growth technology stocks posted large gains in 2017

- However, as a group, those stocks are not outperforming the market in 2018 like they were last year

- Nervousness about global trade, higher market volatility and investor reaction to Facebook’s recent woes have created a rocky road for FAANGs

What Drove FAANG’s Growth in 2017?

Last year, Facebook, Netflix and Amazon all rose more than 50 percent, while the S&P 500 rose 21.8 percent. In comparison, FAANG’s gains were fueled by solid underlying business fundamentals, strong earnings, and a sense that these companies were so dominant in their industries that their long-term growth trajectories would be long. Investors rewarded large companies that seemingly offered both growth and safety in 2017, and the FAANGs exemplified this theme.

What Caused FAANG’s Decline in 2018?

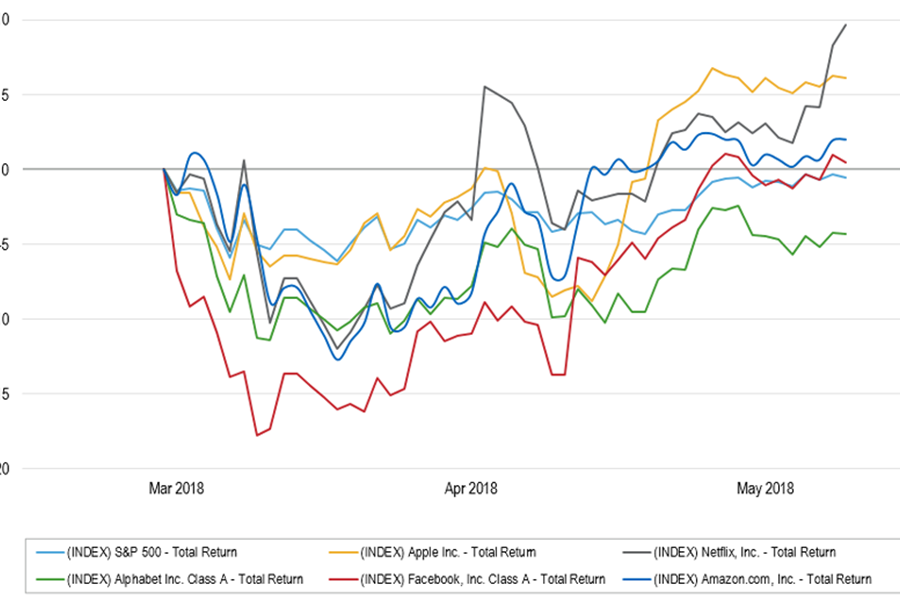

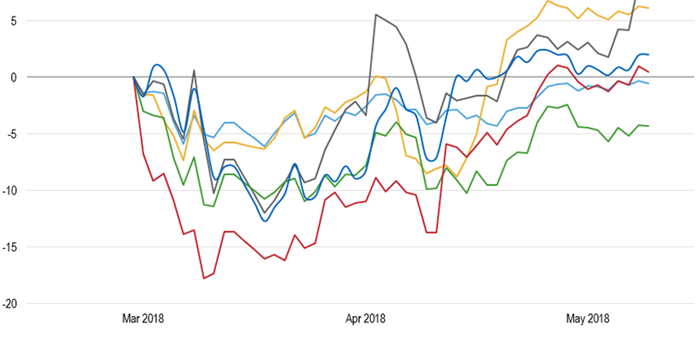

Since mid-March 2018, the FAANG stocks have seen different results as negative news and some near-term growth worries have led investors to a more cautious stance. Recently, Facebook has been hit hard. The stock sank after news came out that Cambridge Analytica, a political data firm hired by President Trump’s 2016 election campaign, gained access to private information for more than 50 million Facebook users. Facebook shares fell almost -14 percent between March 16 and April 25.

Both Alphabet and Amazon also declined in the weeks after the Facebook news hit, even though both Alphabet and Amazon reported strong earnings in Q1. Not only have these shares been beaten up after the Facebook news, they have fallen amid a newly volatile environment in the stock market. In 2017, volatility was almost non-existent as measured by the Chicago Board Options Exchange volatility index, known as the VIX. The low-vol environment contributed to the rise of these shares last year.

What Does the Future of FAANG Look Like?

The long-term growth stories of most of these firms appears to remain intact, despite the near-term performance setbacks. Netflix’s April 16 earnings report showed that profits and subscriber base continue to grow rapidly. Netflix is having the best 2018 of all the FAANGs, up 82 percent YTD through May 24.

Amazon revenue is set to grow around 40 percent (that stock is up more than 37 percent YTD through May 24).

Alphabet revenue growth is predicted to be around 20 percent and some analysts feel long-term prospects are strong, even though the stock has struggled this year.

Apple reported revenue of $61B in Q2 2018 as iPhone sales continue to climb.

And while Facebook may face the biggest struggles among the FAANGs because of the reputational clouds left by the data investigation, its most recent financial report showed that its business is still robust. In the first quarter of 2018, Facebook’s quarterly sales rose by nearly 50 percent. Facebook stock has returned to positive territory for the year to date since that announcement on April 25.

The FAANG moniker is catchy, but the performance drivers are different among these firms and the risks they face are varied. The future is uncertain and the unexpected twists and turns of the markets and competition will affect the FAANGs as companies and their share prices, just as it does with all publicly traded stocks.

Segal Marco Advisors provides consulting advice on asset allocation, investment strategy, manager searches, performance measurement and related issues. The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. Segal Marco Advisors’ R2 Blog and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. Please contact Segal Marco Advisors or another qualified investment professional for advice regarding the evaluation of any specific information, opinion, advice, or other content. Of course, on all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.