Archived Insight | September 11, 2018

What is Driving Short-Term Bonds’ Surprising Success?

By Don Sheridan

Highlights:

- Short-term bonds have performed relatively well recently, despite interest rate increases by the Federal Reserve

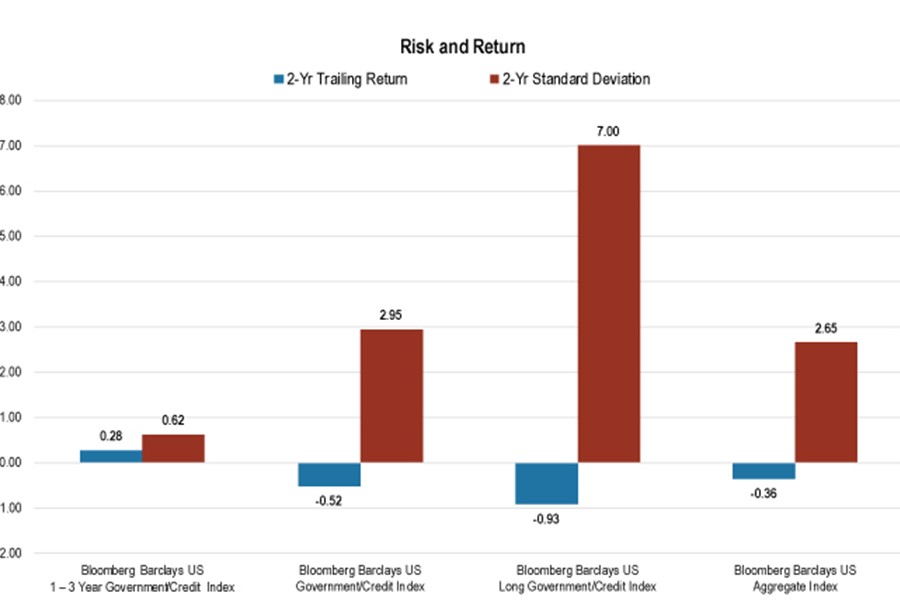

- As longer rates have not risen as much percentage-wise, short-term bonds have still managed to outperform the Bloomberg Barclays US Aggregate Index during the last two years

- Returns in fixed income are unpredictable, as recent performance has shown

- Diversification remains critical

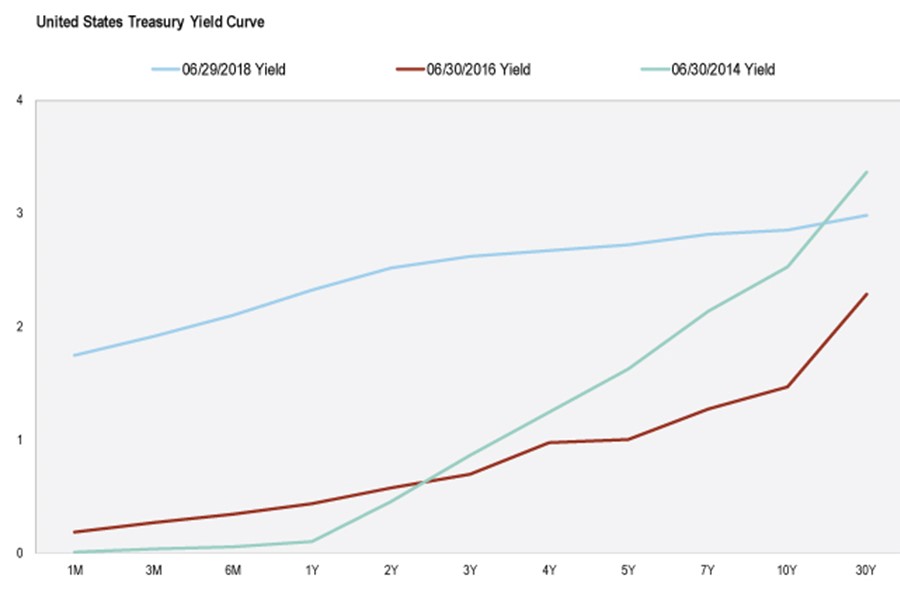

The front end of the Treasury yield curve has risen materially relative to the long end over the last two years. As of the end of June, the 10-year and 30-year yields increased 138 bps and 70 bps, respectively, while the 3-month and 2-year yields increased 165 bps and 194 bps.

Had an investor known that the incremental rise in yield on short-term bonds would be greater than that of long-term bonds two years ago; short-term fixed rate bonds would have seemed less appealing. However, over the last two years, short-term fixed rate bonds had better performance and lower volatility than long-term bonds. The Federal Reserve’s transparent communication about rate hikes, along with some worries about the strength of the global economy, has contributed to this outcome.

What is Driving the Relative Success of Short-Term Bonds?

This upward, nonparallel shift in the yield curve has been driven by the Federal Open Market Committee’s (FOMC’s) decision to raise the policy rate six times, with the potential for two more rate hikes this year (and possibly two to four more next year). An acceleration in real economic growth and a gradual rise in inflation have influenced these policy decisions and outlook. Implied market pricing over the next year is for the Fed to raise rates roughly 70 bps.

If the Fed continues on its intended rate-hiking path, we could surpass the Fed’s so-called “neutral” rate. The neutral rate neither stimulates nor hinders economic growth. We may find ourselves in an environment where higher rates become a headwind to asset prices and the economy.

Unforeseen inflationary pressure leaves the door open for further potential rate hikes beyond what’s currently expected.

However, if inflation expectations don’t change significantly, then we are probably looking at a near-to-medium-term ceiling on short interest rates at around 3 percent. This should be beneficial to a short-duration fixed-rate strategy if spreads continue to tighten and/or the FOMC changes course and eases rates to help jolt the economy.

Diversification is Still the Best Bet for Investing in Fixed Income

Despite short duration’s recent success, investors are still best served by a well-diversified approach to fixed income. Just as one might not have assumed that an investment-grade, short duration fixed rate strategy would offer return enhancement benefits to a fixed income portfolio over the last two years, one should also not assume this will be the case going forward.

Although there is plenty of economic data that supports a short duration allocation, scaling that risk is a key consideration as a diversified investment-grade, fixed income program increases the probability for better long-run risk-adjusted returns.

If interest rate volatility becomes muted, being out of the longer duration sectors would cause investors to miss the potential spread tightening benefits. They may also miss the opportunity to reinvest in higher cash flow generating instruments. But for some, the diversification narrative might be a tough sell right now, with the 3-month Treasury bill yielding 2.11 percent while the 10-year is yielding 2.88 percent (as of 8/28/2018).

This can be particularly tough to justify in an environment where the U.S. Treasury is increasing its borrowing to about $1.25 trillion over the next five years to finance an expanded fiscal deficit. This is something that should push down prices on long-term debt.

However, even when it seems that the technical environment would make bonds perform a certain way, bonds have surprised markets with their recent returns. With this lack of predictability in mind, diversification is always recommended for fixed income investors.

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.