Archived Insight | February 28, 2019

Follow the Bouncing Oil Price: What Goes Down Is Back Up (For Now)

- Oil prices tanked in 2018 with a supply glut and investors’ nervousness about global trade tensions.

- However, oil surged in January 2019, with U.S. interest rates set to increase more slowly and investors more sanguine on global trade prospects.

- The only thing we can predict about oil prices is volatility, so expect more turbulence to come.

Oil has long been a volatile asset class but its performance in recent months has been whiplash inducing.

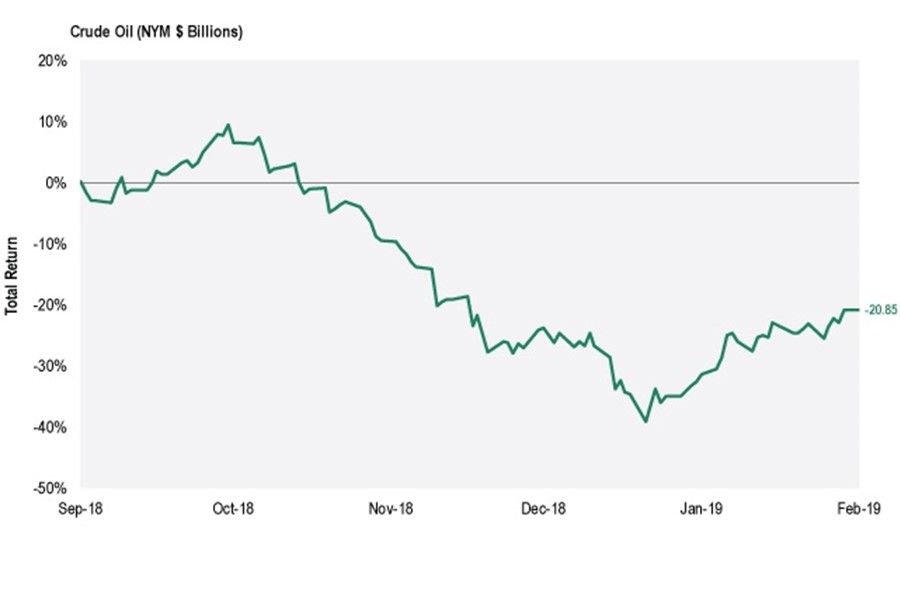

U.S. West Texas Intermediate (WTI) crude prices declined 38% in a period from the end of September 2018 to the end of the year. However, 2019 has been an entirely different story so far. Oil is up 14.5% since January 1.

The change in sentiment around oil comes as the outlook changes for both the commodity and for the global economy.

Late last year’s slide for oil came partly as the Organization of Petroleum Exporting Countries (OPEC) cut output as signs of a supply glut grew. And even though OPEC and Russia said it would cut output, it remains to be seen whether this will actually occur.

That is because Iran, Libya and Venezuela were exempted from the agreement due to their recent economic challenges.

In addition, a surge in fracking in the United States has led American producers to churn out record high amounts of crude, furthering the supply glut.

But that wasn’t all that caused oil to decline. In addition to oversupply in the oil market, the demand side for oil was not looking very robust at the end of 2018, as signs of a global growth slowdown appeared.

The ongoing trade tension between the U.S. and China was also a major reason for 2018’s oil slide. Markets were pessimistic and stocks worldwide endured a steep selloff, which stung oil prices.

So far in 2019, though, oil’s performance has reversed. It has been on a winning streak this year in part because the Federal Reserve said it lowered its projection for interest rate hikes for 2019.

In addition to seeing better economic prospects, investors are also more confident that trade tensions with China will lift in the near term, particularly following a December meeting between President Trump and Chinese president Xi in which the two reportedly agreed to halt new tariffs for 90 days.

Further, OPEC’s new production cuts kicked in this month, taking 800k barrels per day off the market from the start of 2019.

What is the Outlook for Oil Prices Going Forward?

It’s hard to know which view—the more positive recent one or 2018’s gloom and doom—is the correct one.

If global trade tensions have subsided in a sustainable way, and earnings and growth stay steady in 2019, oil prices could climb.

Newly introduced sanctions on Venezuela’s state-owned oil company PDVSA could curtail oil exports, and Libya’s biggest oilfield, El Sharara, is currently occupied by an armed group and closed.

However, there are a few reasons why oil may still struggle in coming months. Global growth is still predicted to slow, which would dent demand for oil.

Trade tensions could continue or grow during the year, which would also likely make investors wary of potential oil demand. And while exports from certain areas may be reduced, global oil supply remains high. Inventory levels are still elevated, and shale production persists.

Also, there is still what’s known as “oil on the water,” or crude that shipped before the OPEC cuts took effect.

No matter how oil actually performs, it can act as a portfolio diversifier and as an inflation hedge.

However, it’s important to remember that oil prices are have long been volatile, and wide swings are a constant part of oil and broader commodities investing.

Further, given the uncertain outlook for oil rich regions and for the global economy, investors should expect continued volatility.

Segal Marco Advisors provides consulting advice on asset allocation, investment strategy, manager searches, performance measurement and related issues. The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. Segal Marco Advisors’ R2 Blog and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. Please contact Segal Marco Advisors or another qualified investment professional for advice regarding the evaluation of any specific information, opinion, advice, or other content. Of course, on all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.