Archived Insight | July 30, 2020

Choose Wisely: Active Equity Management in a Pandemic Meltdown

For the last decade or so, active equity management has been under assault by many in the industry as being too expensive relative to the excess return (if any) provided through the process of assessing various factors to select superior performing securities, sectors, and markets.

We thought it would be interesting to look to the results in the severe market decline in the first quarter of 2020 to see how active management fared during this volatile time.

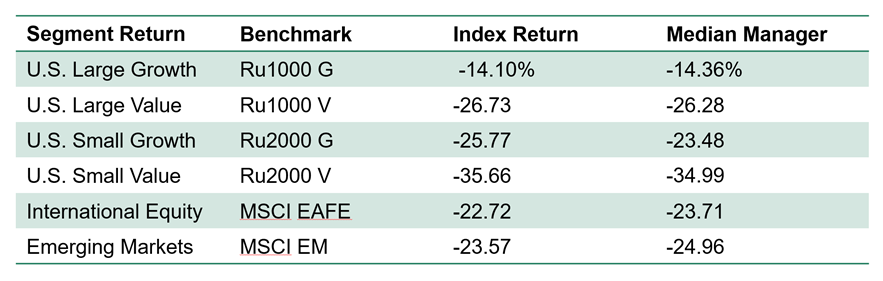

To do this we used the Investment Metrics database of separate accounts and commingled funds, which allowed us to compare median manager returns with benchmarks for several hundred products in each segment of the global equity markets.

The returns shown are gross of fees.

A few things from this table jump off the page, not the least of which is that there was really no place to hide during this period. Even U.S. Large Growth, which was dominated by a handful of stocks that fared well by comparison, had double-digit negative returns.

The second observation is that if we did a little eyeball adjustment for fees, the only segment where active managers had some apparent wind at their back was Small Growth, with the rest of the medians at least a little behind their respective index.

The third point the data indicates is that in almost every case the median manager return is uncannily close to the index results. Noting that this is only one quarter, an extrapolation of the data would tell you what many have suggested – at the end of the day if we accumulate all of the active managers’ results they add up to the index as they collectively are the index.

One might look at this data and conclude that the theory that active managers protect on the downside is patently false, but we don’t believe a meltdown such as this can be predictive or indicative of behavior.

We can, however, use this data as a confirmation of what we have long known about the application of active management in equity investing – if you can’t confidently select above average managers through a rigorous process that enables you to hire and fire successfully, you’ll likely simply end up paying fees to play a zero sum game.

As the knight said to Indiana Jones when he was faced with the prospect of selecting the one true grail from dozens of cups – “Choose wisely.”

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.