After a strong start to the year, February posted negative returns for U.S. equity markets. This was likely due, at least in part, to the uncertain backdrop created by the numerous pronouncements out of the White House, coupled with recent economic indicators. While January’s CPI came in higher than expected the Federal Reserve’s preferred measure of inflation, the PCE, was more muted. The U.S. ISM Manufacturing Purchasing Manager Index results came in slightly weaker than January, but still above 50 (indicating modest growth). Consumer spending was weaker in January, although personal disposable income increased. Consumer confidence indicators experienced the largest decline since August of 2021. So, a very mixed bag of economic data to start the year.

| Equity | YTD (%) | MTD (%) |

|---|---|---|

| All Cap U.S. Stocks |

|

|

| Russell 3000 | 1.2 | -1.9 |

| Growth | -1.8 | -3.7 |

| Value | 4.7 | 0.2 |

| Large Cap U.S. Stocks |

|

|

| S&P 500® | 1.4 | -1.3 |

|

Russell 1000 |

1.4 | -1.7 |

| Growth | -1.7 | -3.6 |

| Value | 5.1 | 0.4 |

|

Mid Cap U.S. Stocks |

|

|

|

S&P 400 |

-0.7 | -4.3 |

|

Russell Midcap |

1.3 | -2.8 |

| Growth | 0.3 | -5.7 |

| Value | 1.6 | -1.8 |

| Small Cap U.S. Stocks |

|

|

| S&P 600 | -3 | -5.7 |

| Russell 2000 | -2.9 | -5.3 |

| Growth | -3.8 | -6.8 |

| Value | -1.9 | -3.8 |

| International |

|

|

| MSCI EAFE NR (USD) | 7.3 | 1.9 |

| MSCI EAFE NR (LOC) | 5.8 | 0.9 |

| MSCI EM NR (USD) | 2.3 | 0.5 |

| MSCI EM NR (LOC) | 2.3 | 0.7 |

| Fixed Income | YTD (%) | MTD (%) |

|---|---|---|

| Bloomberg |

|

|

| U.S. Aggregate | 2.7 | 2.2 |

| U.S. Treasury: 1-3 Year | 1.1 | 0.7 |

| U.S. Treasury | 2.7 | 2.2 |

| U.S. Treasury Long | 5.6 | 5.2 |

| U.S. TIPS | 3.5 | 2.2 |

| U.S. Credit: 1-3 Year | 1.2 | 0.7 |

| U.S. Intermediate Credit | 2 | 1.4 |

| U.S. Credit | 2.6 | 2 |

| U.S. Intermediate G/C | 2 | 1.4 |

| U.S. Govt/Credit | 2.6 | 2.1 |

| U.S. Govt/Credit Long | 4.8 | 4.3 |

| U.S. MBS | 3.1 | 2.6 |

| U.S. Corp High Yield | 2 | 0.7 |

| Global Aggregate (USD) | 2 | 1.4 |

| Emerging Markets (USD) | 2.7 | 1.6 |

| Morningstar/LSTA |

|

|

| Leveraged Loan | 0.8 | 0.1 |

| Alternatives | YTD (%) | MTD (%) |

|---|---|---|

| Bloomberg Commodity | 4.8 | 0.8 |

| S&P GSCI | 1.9 | -1.3 |

Equity markets

While stock markets began the year on a positive note, volatility increased throughout the month and by February sentiment turned negative. The month of February saw a drop in many global equity indices. In the U.S., growth suffered the biggest declines while large cap value was slightly positive (Russell 1000 Growth -3.7 percent, Russell 1000 Value 0.4 percent). Interestingly, the equal-weighted S&P 500 was down -0.6 percent while the S&P 500 was down -1.3 percent. Small and mid cap stocks suffered a larger decline (Russell 2000 -5.4 percent and Russell Midcap -2.8 percent).

Outside the U.S. results were more mixed, with the EAFE positive 1.9 percent driven by Germany and the UK, while Japan was negative as was Canada (tariffs?). Emerging Market equity was up 0.5 percent, thanks to China up 11.8 percent, although India was down -8.0 percent.

So far, through February, markets were holding onto gains for 2025, with the S&P up 1.4 percent year to date, although small and mid cap stocks were in the red, with the impositon of tariffs expected to lead to increased volatility as markets head into spring. Earnings results for the fourth quarter are almost complete (97 percent in), and results have been good for 2024, with many firms noting lots of caution looking ahead for 2025. According to FactSet Earnings Insight, 75 percent of S&P 500 companies have reported earnings per share above expectations and 63 percent have reported positive revenue versus expectations. Future guidance has been largely more muted with tariffs and uncertainty pulling down expectations for the year. With these earnings results, the current forward PE is at 21.2, still above the 10-year average of 18.3.

Fixed income:

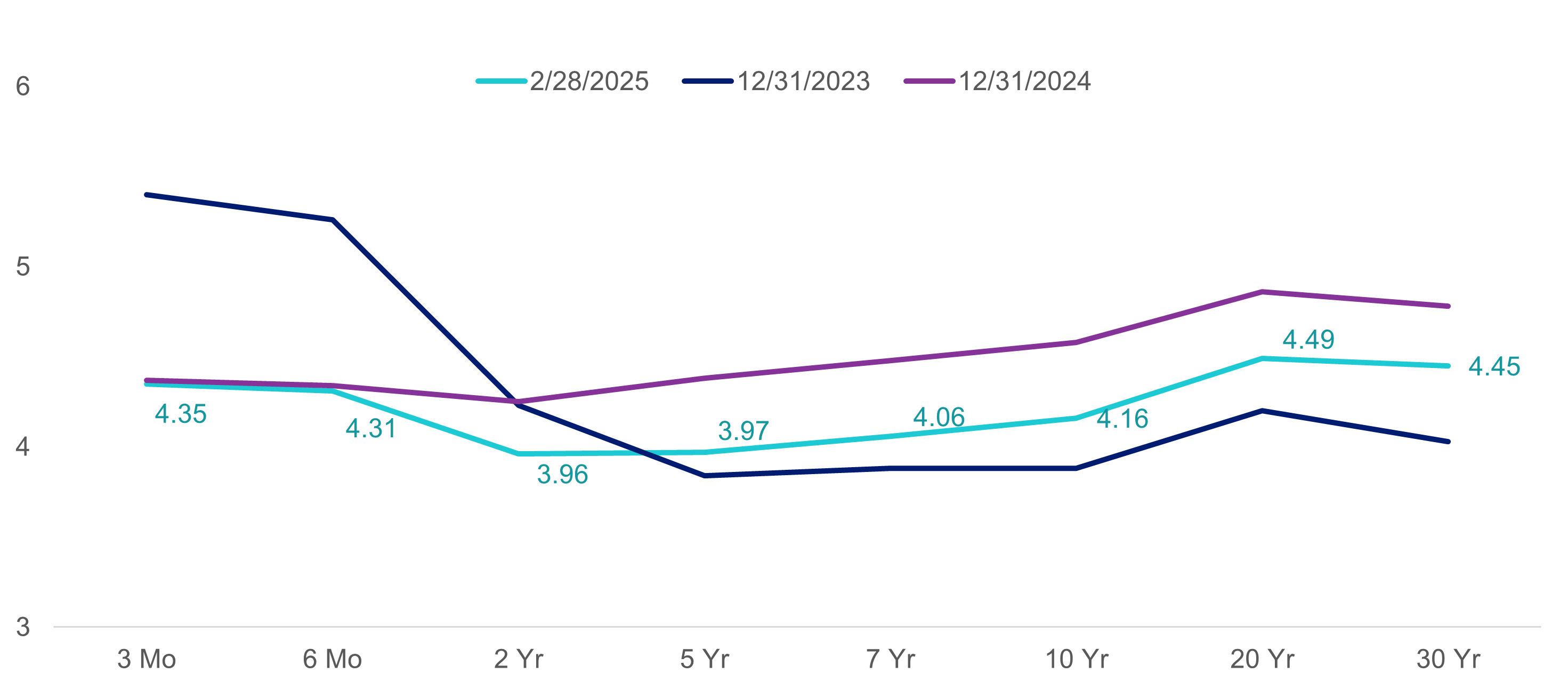

As you can see from the yield curve below, at February month end interest rates (the green line) dropped from the 2-Year Treasury out through the 30-Year Treasury, with the yield curve less flat than at year end. Yields dropped the most at the 5- and 10-year maturities, falling 31 and 33 basis points, respectively. This continues the trend of lower interest rates that began in January.

U.S. Treasury Yield Curve

Source: FactSet

Looking ahead

As we mentioned in the January update, there does not seem to be any slowdown ahead in terms of announcements and pronouncements related to tariffs, immigration, reorganization of the U.S. Government or national security, to name a few. Our advice continues to be focus on the long term, review your strategic asset allocation, rebalance where appropriate and avoid the risk of “short-termism” driving long-term policy decisions.

See more insights

Review of Markets 2024

January 2025 Financial Markets Recap: And So, It Begins

December 2024 Financial Markets Recap: No Santa Claus Rally This Year

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.