Global markets climbed higher, led by the continued rally of the S&P 500®, which has gained over 20 percent since April’s Liberation Day tariff announcement when it was down -15 percent. Despite uncertain global economic conditions and intensifying geopolitical tensions, risk assets were mostly positive in the month and year to date.

| Equity | YTD (%) | MTD (%) |

|---|---|---|

| All Cap U.S. Stocks |

|

|

| Russell 3000 | 5.8 | 5.1 |

| Growth | 5.8 | 6.3 |

| Value | 5.5 | 3.5 |

| Large Cap U.S. Stocks |

|

|

| S&P 500® | 6.2 | 5.1 |

|

Russell 1000 |

6.1 | 5.1 |

| Growth | 6.1 | 6.4 |

| Value | 6.0 | 3.4 |

|

Mid Cap U.S. Stocks |

|

|

|

S&P 400 |

0.2 | 3.6 |

|

Russell Midcap |

4.8 | 3.7 |

| Growth | 9.8 | 4.4 |

| Value | 3.1 | 3.5 |

| Small Cap U.S. Stocks |

|

|

| S&P 600 | -4.5 | 4.0 |

| Russell 2000 | -1.8 | 5.4 |

| Growth | -0.5 | 5.9 |

| Value | -3.2 | 4.9 |

| International |

|

|

| MSCI EAFE NR (USD) | 19.4 | 2.2 |

| MSCI EAFE NR (LOC) | 7.8 | 0.2 |

| MSCI EM NR (USD) | 15.3 | 6.0 |

| MSCI EM NR (LOC) | 10.8 | 4.9 |

| Fixed Income | YTD (%) | MTD (%) |

|---|---|---|

| Bloomberg |

|

|

| U.S. Aggregate | 4.0 | 1.5 |

| U.S. Treasury: 1-3 Year | 2.8 | 0.6 |

| U.S. Treasury | 3.8 | 1.3 |

| U.S. Treasury Long | 3.1 | 2.5 |

| U.S. TIPS | 4.7 | 1.0 |

| U.S. Credit: 1-3 Year | 3.1 | 0.7 |

| U.S. Intermediate Credit | 4.5 | 1.3 |

| U.S. Credit | 4.2 | 1.8 |

| U.S. Intermediate G/C | 4.1 | 1.1 |

| U.S. Govt/Credit | 3.9 | 1.5 |

| U.S. Govt/Credit Long | 3.4 | 2.8 |

| U.S. MBS | 4.2 | 1.8 |

| U.S. Corp High Yield | 4.6 | 1.8 |

| Global Aggregate (USD) | 7.3 | 1.9 |

| Emerging Markets (USD) | 4.9 | 1.9 |

| Morningstar/LSTA |

|

|

| Leveraged Loan | 2.8 | 0.8 |

| Alternative | YTD (%) | MTD (%) |

|---|---|---|

| Bloomberg Commodity | 5.5 | 2.4 |

| S&P GSCI | 1.9 | 4.5 |

Source: Segal Marco Advisors

The S&P indices are a product of S&P Dow Jones Indices, LLC and/or its affiliates (collectively, “S&P Dow Jones”) and has been licensed for use by Segal Marco Advisors. ©2025 S&P Dow Jones Indices, LLC a division of S&P Global Inc. and/or its affiliates. All rights reserved. Please see www.spdji.com for additional information about trademarks and limitations of liability.

U.S. economy

As expected, the Fed held rates steady at 4.25-4.50 percent in June with two rate cuts expected by year-end according to the dot plot. U.S. GDP decreased at a revised annualized growth rate of -0.5 percent in the first quarter, driven by a surge in imports, along with a reduction in government spending. May’s monthly CPI increase of 0.1 percent came in lower than expected as annual inflation rose to 2.4 percent. The Fed’s preferred measure of inflation, core PCE, increased by 0.1 percent in May with an annualized inflation rate of 2.3 percent. The ISM Manufacturing PMI survey results remained steady at 49 (below 50 indicates economic contraction) with improvements in inventories and production. The health of the labor market remains resilient, as the economy added a higher-than-expected 147,000 new jobs in June with the unemployment rate falling to 4.1 percent from 4.2 percent. The Conference Board Consumer Confidence Index survey indicators fell in June given weaker expectations.

Equity markets

U.S. equities continued to rebound with a 5.1 percent return, as the S&P 500 reached an all-time high of 6,205 on the last day of the month. On a sector basis for the month, Information Technology (+9.8 percent) and Communication Services (+7.3 percent) were the top contributors, while Consumer Staples (-1.9 percent) was the lone negative contributor. On a year-to-date basis, the only negative portion of U.S. markets remains small capitalization stocks (S&P 600 index at

-4.5 percent).

International equity markets, including both developed (EAFE +2.2 percent) and emerging regions (EM +6.0 percent), were positive and year to date have outperformed the U.S. Within developed markets, Pacific (+2.3 percent) led the way on a regional basis with the highest return from Portugal (+8.1 percent). Within emerging markets, Eastern Europe (+7.9 percent) outperformed on a regional basis with strong results again from Korea (+17.6 percent).

Fixed income markets

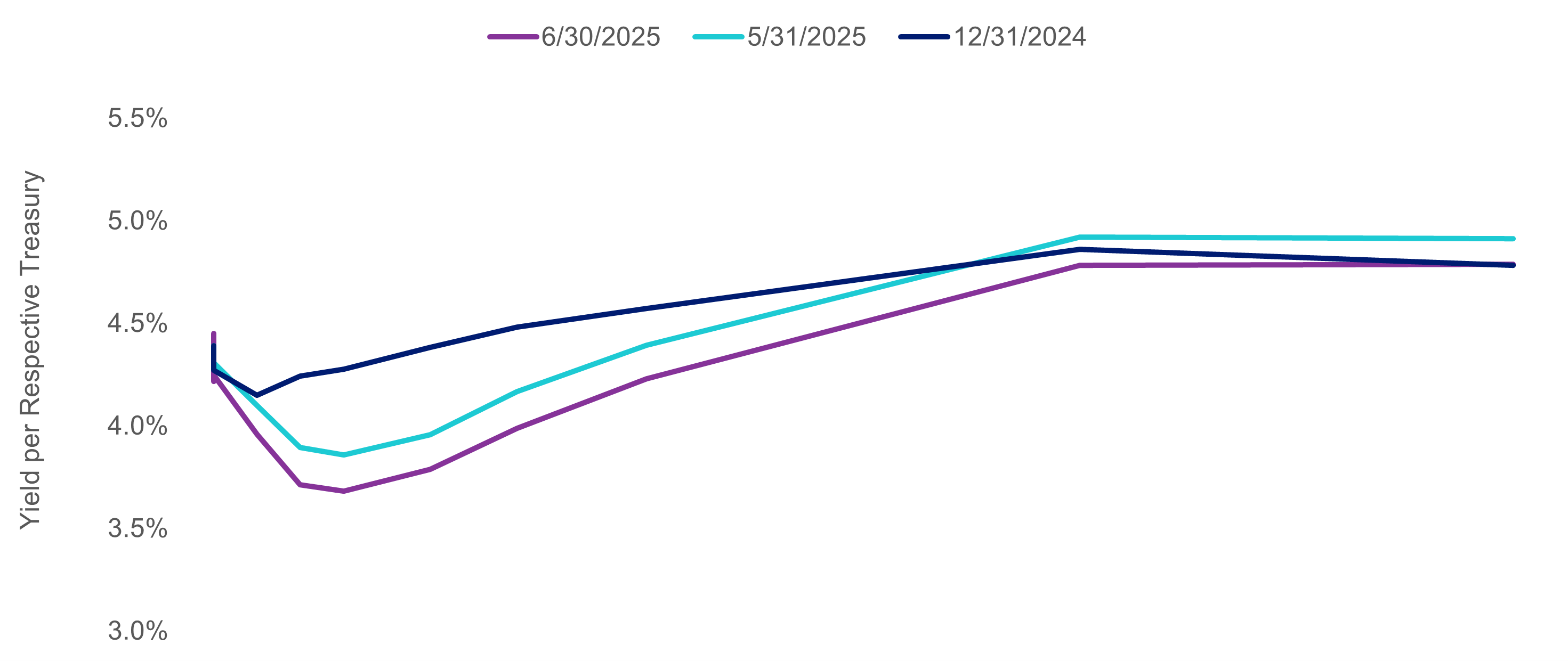

The bond market shrugged off macro concerns around fiscal deficits, inflation and tariffs. Against this backdrop, fixed income returns were positive, with U.S. Treasury yields falling (inversely prices increased, hence positive returns) across the curve with 2-year U.S. Treasury bonds falling 14 bps to 3.7 percent and 30-year Treasuries falling by 12 bps to 4.8 percent. Investment-grade, high-yield and mortgage-backed securities all saw slightly tightened spreads contribute to positive results across the bond spectrum.

U.S. Treasury Yield Curve

Source: Factset

Looking ahead

Another positive month in stocks and bonds provided a reason for optimism. However, a return of market turbulence would not be surprising given continued political developments such as the recent passage of the “Big Beautiful Bill” and stretched equity valuations. In the face of any ensuing heightened volatility, we continue to advise clients to retain a disciplined approach by focusing on asset allocation, rebalancing as appropriate and maintaining sufficient reserves to pay benefits.

See more insights

Trump Tariffs 2.0000000? (Sequel?)

April 2025 Financial Markets

May 2025 Financial Markets

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.