Articles | April 27, 2022

Model Pension Plan's Funded Status Rises

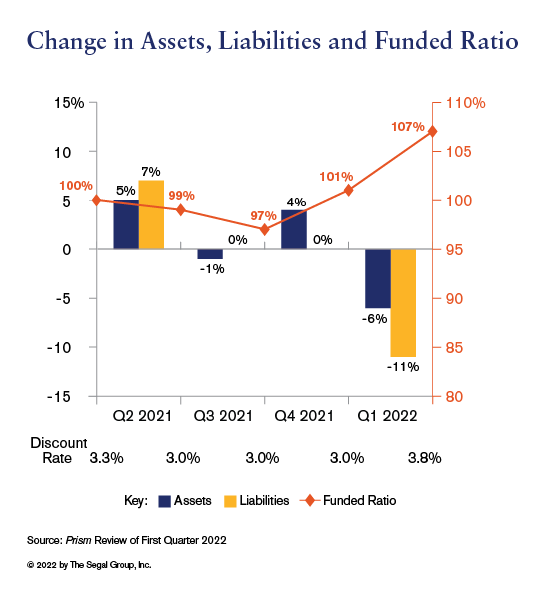

During the first quarter of 2022, the funded status of the model pension plan examined in each issue of Prism rose by 6 percentage points, to 107 percent, as illustrated in the graph below.

This increase in funded status is primarily attributable to a 11 percent decrease in liabilities, partially offset by a 6 percent decrease in assets.

Aspects of investment performance that contributed to the loss in asset value

Equity and fixed income returns were negative across the board during Q1, as Russia’s invasion of Ukraine and relentlessly increasing inflation readings globally dominated headlines.

U.S. equity markets had their worst performance since Q1 2020 (when COVID-19 lockdowns began), with March providing slightly positive returns, which could not offset the negative returns during the first two months of the quarter.

Fixed income returns were poor both domestically and internationally as interest rates soared across the globe.

See more insights

January 2026 Financial Markets Recap: And So, It Begins

What to Consider When Selecting a Strategy for a Diversified Active Fixed Income Allocation

December 2025 Financial Markets

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.