Reports | December 16, 2021

Second Annual Survey of Investment Managers’ Internal ESG Practices Finds Progress on Some Issues

Segal Marco Advisors’ second iteration of its ESG Survey of Investment Managers revealed some progress on ESG issues, while many responses were similar to the prior year.

As we did in 2020, Segal Marco surveyed our top 100 managers by client assets on their ESG practices. The questions ranged from topics like diversity, equity and inclusion to environmental practices and work-from-home policies during the COVID-19 pandemic.

Key findings

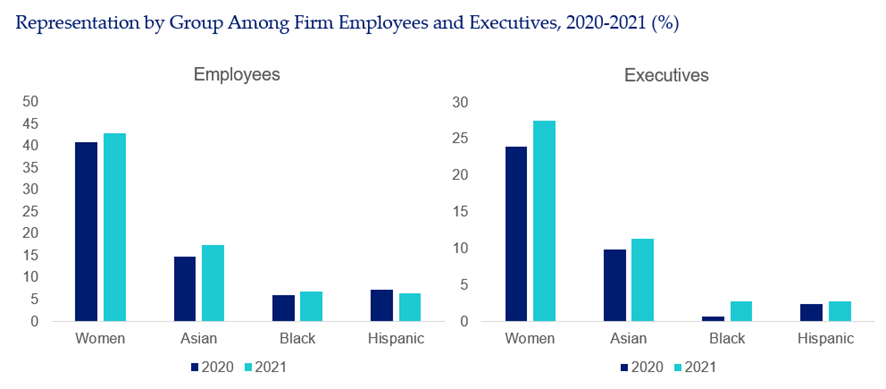

One finding of this year’s survey is that, on the whole, staff and executives are more diverse.

We expect any change in a single year to be modest given that the vast majority of these firms have a turnover rate between 0 and 10 percent. Still, modest progress is a hopeful sign that the finance industry is waking up to its diversity problem and taking action. Specifically, we observed the modest increases across the workforces shown in the graph below. We also saw more firms reporting on staff that were non-gender conforming, although the percentage of overall staff is marginal.

Request the Full Survey Results

Firms showed less action on pay parity assessments, which investigate potential bias in compensation based on gender and/or race. Many of the firms operate in the UK where there is a requirement to provide pay parity reports for companies with more than 250 employees. Despite the UK requirement, we found reporting firms aren’t necessarily conducting similar exercises across the global and/or U.S. workforce. Our survey asked if firms assessed gender pay equity and we noted a slight decline in positive responses, from 39.5 percent to 37.5 percent. Similar to last year, among those that assessed pay parity, few were willing to report the income gap. The 10 firms that chose to provide it had a range of responses from zero to 35 percent.

On environmental issues, investment managers have become resources for clients seeking to reduce the carbon emissions count of their portfolios. More than one-third of managers track carbon emissions for clients. The survey focused on internal practices at the management firms. There, too, we saw a notable uptake on carbon initiatives. About half of the managers are already in the process of tracking their own carbon emissions. One-fourth of firms have made net-zero commitments. The trend towards more climate awareness is also reflected in firms providing carbon offsets, which increased 37 percent since 2020. There is plenty of room for improvement on climate-aware services, which may become a differentiator for clients moving in that direction.

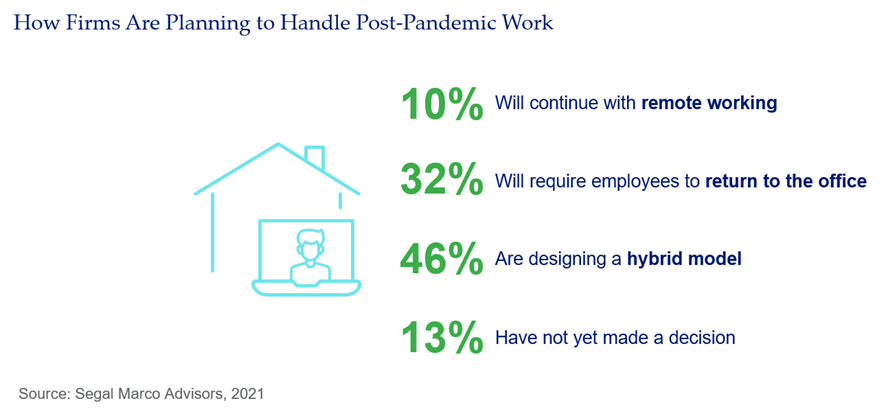

We also noted changes in firms’ human capital management practices. Given the ongoing COVID-19 pandemic, a not-so-surprising finding is that staff are either working remotely at 74 percent of firms or working in the office on a voluntary basis at the other 26 percent of firms. Future plans were more nuanced, as illustrated in the pie chart.

Networking groups for underrepresented segments of the population and parental-leave support are both on the rise. More firms are also providing tuition and certification reimbursement, mentorship programs and internships. Some firms are offering ancillary benefits, such as professional coaching, internal mobility programs and loan-debt repayment assistance.

The survey found that, by and large, firms had more independent directors on their boards in 2021 than in 2020. Finally, a larger percentage of respondents (73.2 percent compared to 69.1 percent in 2020) reported that they provide employees with an opportunity to buy ownership stakes in the firm.

Overall, many of the 2021 survey results are consistent with what we found last year. We noted gains in diversity and inclusion, but progress on equity was less clear. Firms are reporting more activity on carbon counting as the world grapples with the challenge of slowing the tide of climate change. Responses indicated that the remote work environment prompted by the pandemic is unlikely to reverse course for most firms.

About the survey

In June 2021, we invited 100 investment management firms to participate in a survey of their internal ESG policies and practices. The survey consisted of a select number of questions that were identical to the questions we asked the firms in 2020, along with some new additions. The response rate for the survey is 82 percent.

See more insights

2021 Corporate Sustainability Report

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.