Archived Insight | July 21, 2020

Breaking down the U.S. Equity Market: Six Versus 494

Since the beginning of 2020 we have been through pretty turbulent times in the U.S. equity market. The impacts of the pandemic were reflected in dramatic market declines, which were followed by substantial recovery as investors began to look past the near term economic damage.

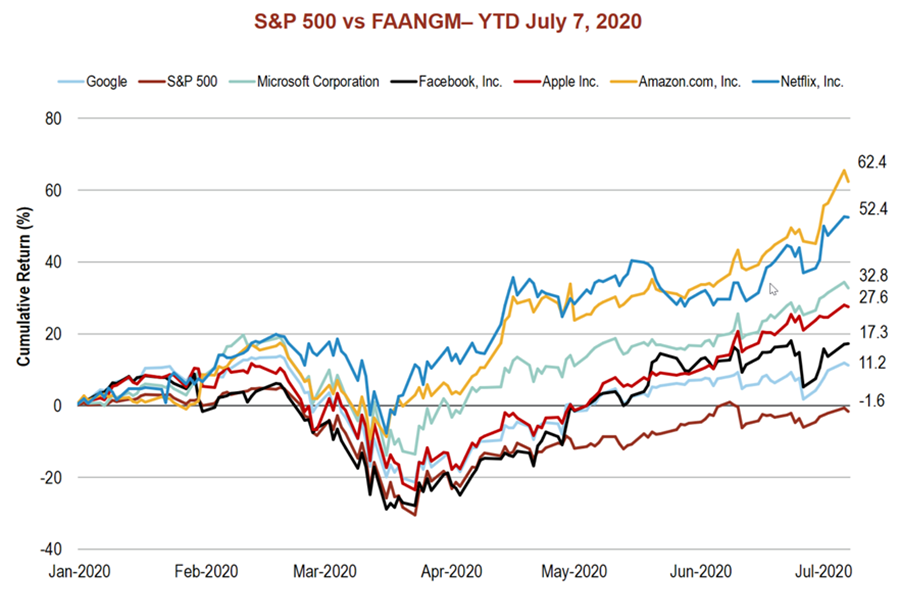

Net, the S&P 500 year-to-date as of this writing has declined only about -1.6 percent, which certainly isn’t calamitous.

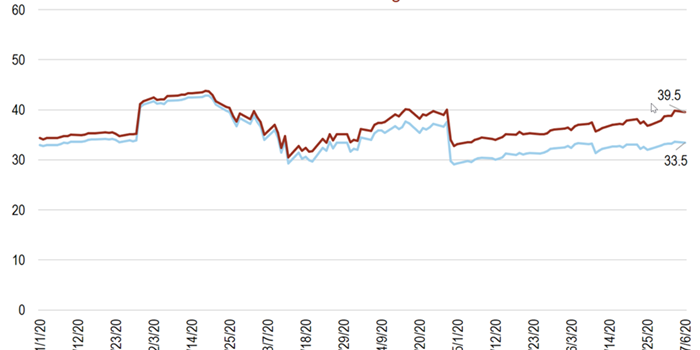

Yet as the first chart shows, this doesn’t tell the entire story as six stocks, which now represent about 20 percent of the capitalization of that index, actually performed quite well over this time period.

These companies especially benefited in helping their customers survive a lockdown.

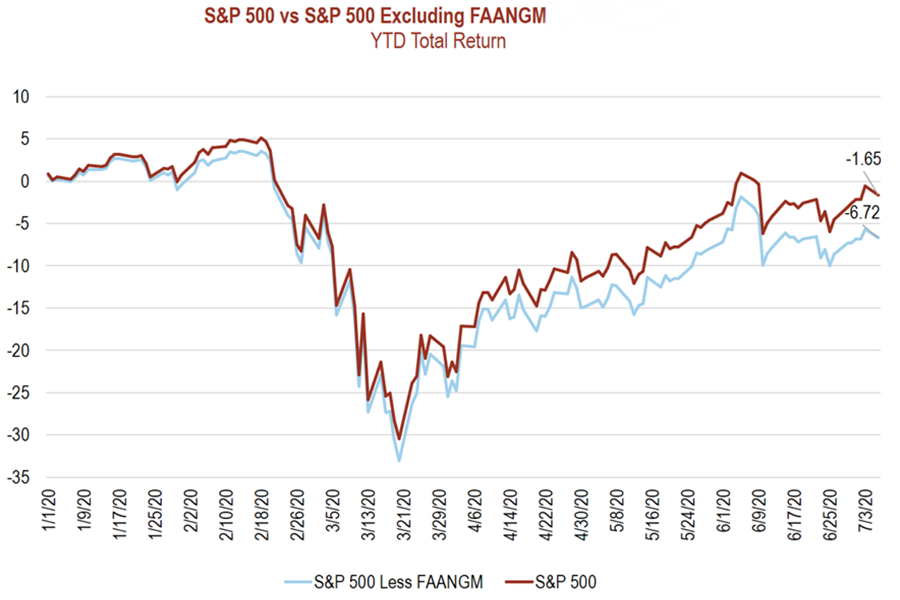

Looking at the impact of just these six companies on the entire market over this period, we note below that were it not for their favorable appreciation the market would have been down nearly -7 percent versus the actual result of -1.6 percent. This is a much bleaker picture.

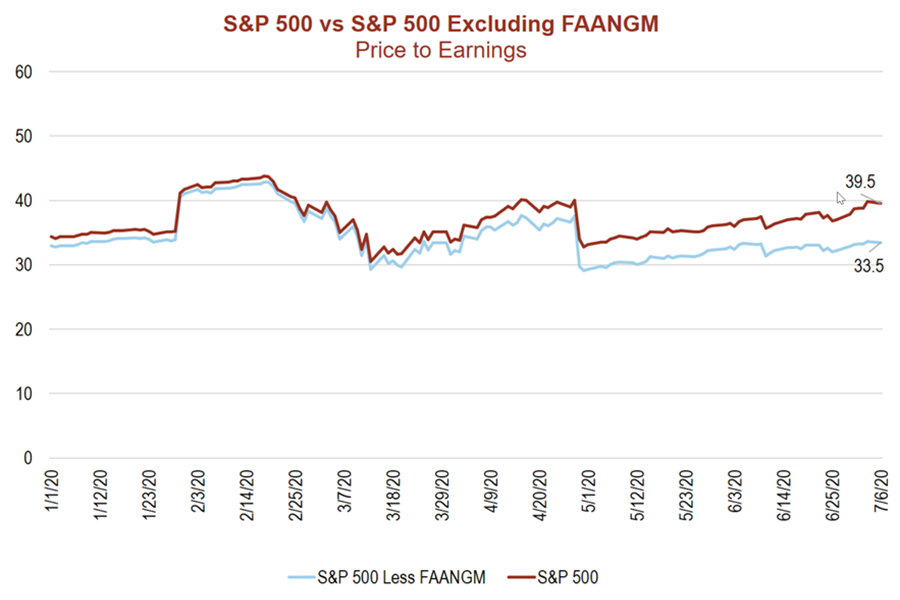

Finally, we took a look at the impact of those companies upon valuations as measured by the price-earnings ratio (P/E). While by this single numeric representation of cheapness the market is quite expensive, removing those six firms reduced the P/E measure by 15%. Still expensive, but certainly much less so.

There are a few ways to look at this data –

- Thank goodness for these strong American companies, both in terms of the role they played and their contribution to equity returns.

- Six companies drove that much of the market. Doesn’t that create a significant risk if a reversal were to occur?

- Are these high P/Es for the six telling us that we can expect a long period where the Amazons of the world will grow and prosper as the post-COVID world settles in for a new normal?

See more insights

May 2025 Financial Markets

April 2025 Financial Markets

Trump Tariffs 2.0000000? (Sequel?)

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.