To celebrate the end of summer, markets took us on a rollercoaster ride during the month of August. After tremendous volatility early in the month, the rollercoaster slowed and came to a stop, with positive results for most global stock markets by the time the ride was over. Fixed income markets were positive on the back of lower rates and continued the trend of positive returns for bonds over the last four months.

Although the early month declines were precipitated by weakness in labor data, the trend of most economic data has remained intact. Inflation continues to trend toward the Federal Reserve’s 2 percent target, GDP continues to be positive, albeit slightly lower, than earlier in the year and consumer spending remains positive. All of which portend a supportive backdrop for the Federal Reserve to consider cutting interest rates in September. While futures markets are projecting eight interest rate cuts through 2025, that may prove excessive, barring any materially negative surprises on the labor or economic front.

August 2024 Investment Performance v. Year to Date Performance

| Equities | August 2024 (%) | Year to Date 2024 |

|---|---|---|

| All Cap U.S. Stocks |

|

|

| Russell 3000 | 2.2 | 18.2 |

| Growth | 1.9 | 20.7 |

| Value | 2.4 | 14.7 |

| Large Cap U.S. Stocks |

|

|

| S&P 500® | 2.4 | 19.5 |

|

Russell 1000 |

2.4 | 18.6 |

| Growth | 2.1 | 21.1 |

| Value | 2.7 | 15.1 |

|

Mid Cap U.S. Stocks |

|

|

|

S&P 400 |

-0.1 | 12.2 |

|

Russell Midcap |

2 | 12.1 |

| Growth | 2.5 | 9.3 |

| Value | 1.9 | 13 |

| Small Cap U.S. Stocks |

|

|

| S&P 600 | -1.4 | 8.4 |

| Russell 2000 | -1.5 | 10.4 |

| Growth | -1.1 | 11.7 |

| Value | -1.9 | 9.1 |

| International |

|

|

| MSCI EAFE NR (USD) | 3.3 | 12 |

| MSCI EAFE NR (LOC) | 0.4 | 12.4 |

| MSCI EM NR (USD) | 1.6 | 9.5 |

| MSCI EM NR (LOC) | 0.4 | 12.1 |

| Fixed Income | August 2024 (%) | Year to Date 2024 |

|---|---|---|

| Bloomberg |

|

|

| U.S. Aggregate | 1.4 | 3.1 |

| U.S. Treasury: 1-3 Year | 0.9 | 3.3 |

| U.S. Treasury | 1.3 | 2.6 |

| U.S. Treasury Long | 2 | 0.4 |

| U.S. TIPS | 0.8 | 3.3 |

| U.S. Credit: 1-3 Year | 0.9 | 4 |

| U.S. Intermediate Credit | 1.3 | 4.2 |

| U.S. Credit | 1.6 | 3.5 |

| U.S. Intermediate G/C | 1.2 | 3.6 |

| U.S. Govt/Credit | 1.4 | 3 |

| U.S. Govt/Credit Long | 2.1 | 1.2 |

| U.S. MBS | 1.6 | 3.3 |

| U.S. Corp High Yield | 1.6 | 6.3 |

| Global Aggregate (USD) | 2.4 | 1.9 |

| Emerging Markets (USD) | 2.1 | 6.3 |

| Morningstar/LSTA |

|

|

| Leveraged Loan | 0.6 | 5.8 |

| Alternatives | August 2024 | Year to Date 2024 |

|---|---|---|

| Bloomberg Commodity | 0 | 0.9 |

| S&P GSCI | -1.7 | 5.3 |

Sources: Standard & Poor's, Bloomberg, MSCI and Russell

The S&P indices are a product of S&P Dow Jones Indices, LLC and/or its affiliates (collectively, “S&P Dow Jones”) and has been licensed for use by Segal Marco Advisors. ©2024 S&P Dow Jones Indices, LLC a division of S&P Global Inc. and/or its affiliates. All rights reserved. Please see www.spdji.com for additional information about trademarks and limitations of liability.

Equity markets

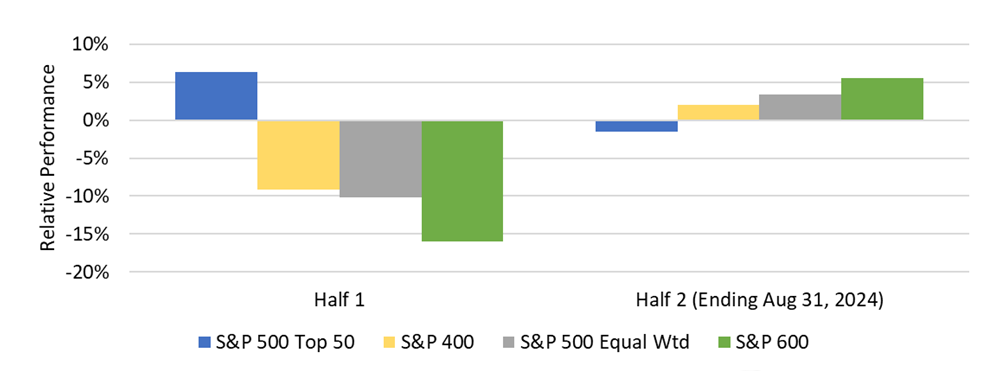

As is often the case, there are more than just one or two economic factors driving the market. The early month’s large declines and increased volatility resulted from a combination of factors, including an unwind of the Japanese carry trade, and the concentrated tech/AI trade falling back to earth. As we have discussed in previous monthly reviews, the equity markets this year have largely been driven by the stocks of a concentrated number of growth/technology related companies. The early August declines were led by these growth/technology stocks, while the first-half underperformers, namely small stocks and value stocks, were up. Although small cap stocks were down in August (the Russell 2000 was down -1.5 percent; up 10.4 percent year to date), they are still outperforming so far in the second half of the year, (see chart below). Large cap value stocks outperformed large cap growth stocks in August (Russell 1000 Value 2.7 percent, Russell 1000 Growth 2.1 percent).

U.S. Equity Index Performance

Source: FactSet

As for outside of the U.S., both the EAFE and Emerging Market indices were up, with the 3.3 percent return for the EAFE leading all markets in the month of August. Emerging Markets were up 1.6 percent, helped by the decline in the dollar during the month.

Fixed income

In August, the Bloomberg Aggregate Index returned 1.4 percent. With four consecutive months of positive bond performance, the Bloomberg Aggregate index is solidly in the green at 3.1 percent year to date. Yields closed lower (prices up) again behind the consensus that a rate cut would come in September. The ten-year Treasury bond closed August at a yield of 3.91 percent, matching levels seen in early January and near the low of early August of 3.78 percent. The two-year Treasury also closed at 3.91 percent, meaning a flat yield between the 2’s to 10’s. Long duration bonds were the best performers again this month with a return of 2.0 percent, bringing the quarter to date to 5.7 percent (although year-to-date the return is only 0.4 percent). Non-U.S. bonds also performed well, with a return of 2.4 percent for the Global Aggregate Index.

Looking ahead

In a few short weeks, we will know if the long-awaited Fed rate cut has materialized. If it does, as seems probable, the market may react positively, or may just as easily take a breath after already pricing in the event. Quarter-to-date, the S&P 500 is up 3.7 percent, with one month to go to finish up the third quarter (and a strong 19.5 percent year to date). As for the fourth quarter? The fall election cycle is a wild card, which is likely to add to volatility. It is already clear businesses are cutting back on spending, waiting to see which party assumes control. Will consumers follow suit? As we always advise, do not try to time the market, rebalance to targets and focus beyond any near-term swings.

For you football fans, that magical time of year is back! Good luck to all your teams, whomever they are.

See more insights

Mid-Year Market Outlook: Rotation or More of the Same?

July 2024 Market Update: Rotation?

State-Facilitated Retirement Savings Programs and Defined Contribution Plans

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.