2022 has been characterized by enormous change.

That's certainly something that everyone can agree upon.

Let’s look at a small sample of this year’s changes:

- Financial:

- Inflation is at a 40-year high.

- Interest rates have risen across the yield curve by more than 250 basis points.

- In the last quarter alone, as a group 55 central banks have raised rates 62 times

- Gas prices are the highest we've seen in 14 years.

- Stock and bond markets are both negative in the year to date.

- Stock and bond issuance declined dramatically. In Q1 global equity capital markets activity dropped 67 percent to $121B — the slowest opening quarter since 2016, according to Refinitiv. Year over year, U.S. investment-grade issuance was down 14 percent through April, and Fitch Ratings reports that high-yield issuance fell 75 percent during that period.

- Geopolitical

- War (first European invasion of a country since WWII, if you don’t count Crimea)

- Food and energy security concerns in Europe and many emerging countries

- Social:

- U.S. Supreme Court decision overturning Roe v. Wade (first constitutional change to abortion access since the Roe decision was handed down in 1973)

- Gun legislation (first gun legislation passed by Congress in nearly three decades)

- Consumer sentiment (Michigan Consumer Sentiment went from the highs of mid-2021 to near all-time lows now)

Why change is difficult

A Harvard Business Review article on “10 Reasons People Hate Change” by Rosabeth Moss Kanter provides the following reasons why change is difficult:

- Loss of control

- Excess uncertainty

- Surprise, surprise!

- Loss of face

- Everything seems different.

- Concerns about competence

- More work

- Ripple effect

- Past resentments

- Sometimes the threat is real.

I am not sure we could have outlined the year 2022 any better than this list.

Year to date we have experienced enough change for everyone to feel anxious.

How do we cope? Context

When uncertainty abounds, people seek to control what they can. Sometimes this leads to decisions that are counterproductive.

For example, to sell your stocks and bonds right now might provide “relief,” a sense of controlling any more downside, but it would not be advisable. Instead, we advise sticking to your long-term plan. Asset allocation is set over a multi-year time frame. That’s why it’s important to take a step back and try not to just focus on the one-year or year-to-date returns, though they are not pretty.

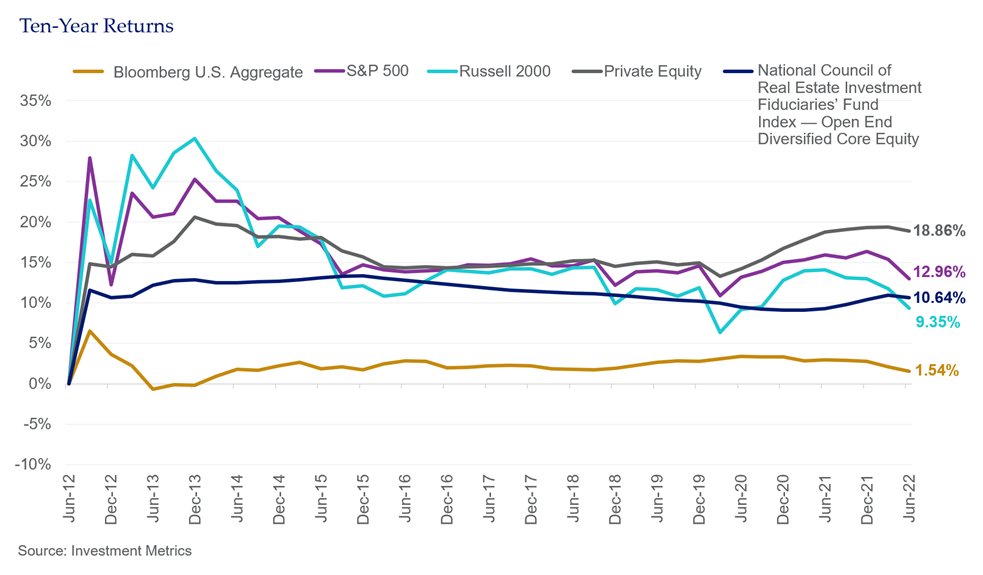

Look at the long term. Capital markets have provided some very positive performance over the last decade and while it’s been a long time since we’ve felt negative performance like this, even including the 2022 year to date, look at the percentages at the end of each line in the graph below.

The last 10 years have provided positive financial market returns. The S&P 500® is up 13 percent. The Russell 2000 small cap stock index returned 9.4 percent for the 10 years that ended in June (this is after the worst six months for the Russell 2000, since inception). Over that 10-year period, real estate was up 10.6 percent and private equity returned 18.9 percent. The Bloomberg U.S. Aggregate Bond Index is up 1.5 percent, and this is after the worst bond market performance in 2022 ever. So, virtually all your assets helped to provide a positive return environment.

Now, this past 10-year period was characterized by a backdrop of excess liquidity and the “Fed put” has anchored the low-inflation, low-growth world. This has changed, no doubt. But for those of us who have lived through an inflationary time (or a stagflationary one, depending on the outcome), we have been through this before; it’s just that most people don’t remember it. Markets have and always will fluctuate to the upside and downside.

Whenever there is change, opportunities present themselves

Look at your portfolio allocation and make sure that you maintain diversification. Where and when the market opportunities arise is unclear right now, so broad diversification can provide a measure of upside when the standard deviation of outcomes is large.

Importantly, while change is hard, change is also inevitable. It is growth that is optional.

See more insights

Core Fixed Income Investing in a Challenging Bond Market

Stagflation: What Is It, and Is It on the Horizon?

What Is Greenwashing?

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.