The adage “Comes in like a lion and out like a lamb” is not a good description of how March 2024 unfolded. Early in the month, equity returns were muted, especially compared to January and February. Bonds, on the other hand, were positive early and faded a bit over the month. Inflation data came in a little hot on a CPI basis, although year over year PCE of 2.5 percent for February were in line with expectations, if slightly higher than January’s reading of 2.4 percent. Housing remained elevated and the largest increases in the month were related to energy from higher gas prices.

Despite some concern on inflation and the pace of Federal Reserve (the Fed) rate cuts, returns were positive overall in March across financial assets.

For the quarter, equity returns were strong across the board, while bonds were mixed depending on sector and duration.

March 2024 Investment Performance Compared v. Year-to-Date Performance

| Equities | March 2024 (%) | Year to Date 2024 |

|---|---|---|

| All Cap U.S. Stocks |

|

|

| Russell 3000 | 3.4 | 10.2 |

| Growth | 1.7 | 11.1 |

| Value | 5.4 | 9.1 |

|

Large Cap U.S. Stocks |

|

|

|

S&P 500® |

3.3 | 10.7 |

|

Russell 1000 |

3.3 | 10.4 |

| Growth | 1.6 | 11.3 |

| Value | 5.4 | 9.4 |

|

Mid Cap U.S. Stocks |

|

|

|

S&P 400 |

6.0 | 10.4 |

|

Russell Midcap |

4.7 | 9.0 |

| Growth | 2.5 | 9.6 |

| Value | 5.7 | 8.8 |

| Small Cap U.S. Stocks |

|

|

| S&P 600 | 3.9 | 3.1 |

| Russell 2000 | 4.1 | 5.7 |

| Growth | 3.0 | 7.8 |

| Value | 5.2 | 3.7 |

| International |

|

|

| MSCI EAFE NR (USD) | 3.3 | 5.8 |

| MSCI EAFE NR (LOC) | 4.0 | 10.0 |

| MSCI EM NR (USD) | 2.5 | 2.4 |

| MSCI EM NR (LOC) | 3.0 | 4.5 |

| Fixed Income | March 2024 (%) | Year to Date 2024 |

|---|---|---|

| Bloomberg |

|

|

| U.S. Aggregate | 0.9 | -0.8 |

| U.S. Treasury: 1-3 Year | 0.4 | 0.3 |

| U.S. Treasury | 0.6 | -1.0 |

| U.S. Treasury Long | 1.4 | -3.1 |

| U.S. TIPS | 1.0 | 0.1 |

| U.S. Credit: 1-3 Year | 0.5 | 0.7 |

| U.S. Intermediate Credit | 0.9 | 0.2 |

| U.S. Credit | 1.3 | -0.3 |

| U.S. Intermediate G/C | 0.6 | -0.2 |

| U.S. Govt/Credit | 0.9 | -0.7 |

| U.S. Govt/Credit Long | 1.8 | -2.2 |

| U.S. MBS | 0.9 | -1.2 |

| U.S. Corp High Yield | 1.3 | 1.6 |

| Global Aggregate (USD) | 0.6 | -2.1 |

| Emerging Markets (USD) | 1.8 | 1.6 |

| Morningstar/LSTA |

|

|

| Leveraged Loan | 0.7 | 2.3 |

| Alternatives | March 2024 | Year to Date 2024 |

|---|---|---|

| Bloomberg Commodity | 4.6 | 3.4 |

| S&P GSCI | 6.3 | 12.0 |

Sources: Standard & Poor's, Bloomberg, MSCI and Russell

The S&P indices are a product of S&P Dow Jones Indices, LLC and/or its affiliates (collectively, “S&P Dow Jones”) and has been licensed for use by Segal Marco Advisors. ©2024 S&P Dow Jones Indices, LLC a division of S&P Global Inc. and/or its affiliates. All rights reserved. Please see www.spdji.com for additional information about trademarks and limitations of liability.

Equity markets

During the month, we saw a broadening of returns from growth into value stocks, while small cap and mid cap stocks outperformed large cap stocks.

Non-U.S. stocks performed about the same as large cap U.S. stocks overall. The quarter brought another double-digit return (10.2 percent) for U.S. stocks and year-to-date growth has outperformed value. However, the broadening of the market in March provided a positive fundamental backdrop where we also saw the doors to the IPO market reopen, bolstering the smaller end of the market, and hopefully accelerating some private equity distributions as we go through the year.

Fixed income markets

Bond market performance is still about the Fed and potential rate cuts, as volatility continued in the month and quarter. The Bloomberg Aggregate Bond Index returned 0.9 percent in March, with high yield (1.3 percent), long duration (1.4 percent) and emerging markets (1.8 percent) providing the best returns in the month. For the quarter, the Bloomberg Aggregate was still negative (-0.8 percent), and high yield and emerging markets bonds were the best performers, each returning 1.6 percent.

Looking ahead

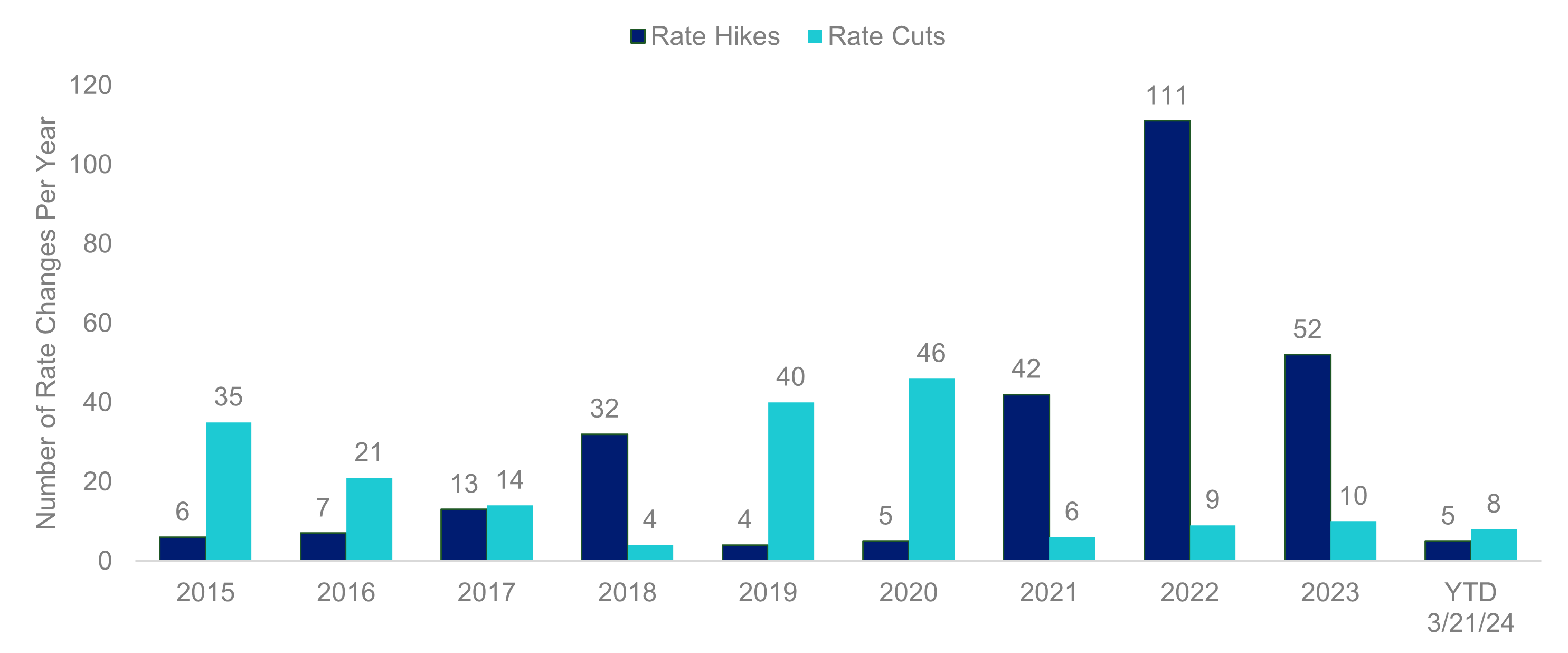

With the first quarter of 2024 behind us, the global monetary environment has changed from the last three years. Already this year there have been more rate cuts than rate increases around the globe, as illustrated in the graph.

Number of Global Rate Hikes and Cuts, 2015 to March 31, 2024

Source: FactSet

This experience sets the stage for new phases of economic cycles, and with it a high probability of differing results, providing potential for both opportunity and volatility.

With the added backdrop that the U.S. has been the developed world's preeminent growth engine, the question remains: can “Goldilocks growth” continue while defeating the inflation beast?

As Fed Chair Jerome Powell stated in his March 6 testimony to Congress:

If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year. But the economic outlook is uncertain, and ongoing progress toward our 2 percent inflation objective is not assured.

So, it seems prudent that we should continue to watch the data this spring and summer.

See more insights

2-Point Decline in Model Pension Plan’s Funded Status

New Reporting Requirements for Environmental Proposals Are on the Horizon

February 2024 Market Review and a Look Ahead

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.