Articles | June 17, 2022

Reviewing the Performance of Multi-Asset Class Solutions

On June 15, 2022, the U.S. Federal Reserve (the Fed) announced a 0.75 percent increase in the federal funds rate, its third rate hike of the year and the largest rate hike since 1994.

The recent moves have certainly raised the cost of borrowing for individuals and corporations and, equally as significant, have officially ushered in a new rate regime. This shift in policy is largely an attempt to combat heightened inflation pressures stemming, in part, from the strong economic recovery that immediately followed the depths of the COVID-19 pandemic.

But what was once considered by the Fed and other qualified market prognosticators to be “transitory” effects of the recent pandemic are now widely viewed as having potentially serious long-term implications on economic growth and societal well-being. Market prognosticators are largely of the view that the Fed will continue to raise rates throughout 2022 and potentially into 2023 to address this growing concern.

In response, investors have allocated considerable time and resources to reexamining their portfolios’ sensitivities to changes in interest rates as well as to the impacts of a (potentially) prolonged period of heightened inflation. Understandably, public equities and fixed income have been the focal points of any discussions on the potential impacts of surging inflation and rising interest rates, given the prominence of these asset classes within portfolios.

However, there has been limited analysis and discussion on the potential benefits and roles that multi-asset class solutions (MACS) can play in offsetting the consequences of rising rates and elevated inflationary pressures or even in capitalizing on the prevailing market conditions. We address that topic in this article and our downloadable detailed report.

Rising rate periods and MACS performance

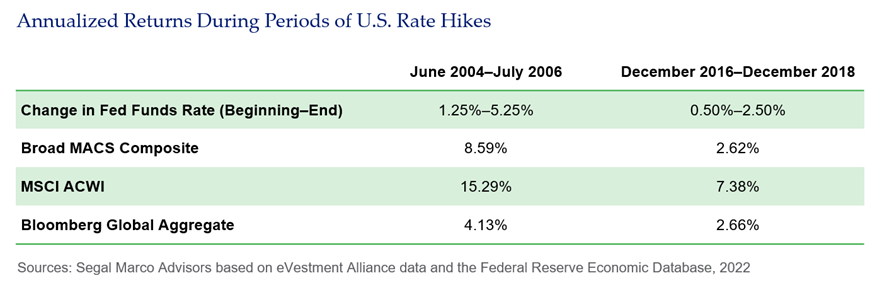

Over the past two decades, there have been two periods of consistent rising rates: June 2004 through July 2006 and December 2016 through December 2018. The following table shows returns for these periods for market indices (which serve as proxies for traditional asset classes) and for MACS using Segal Marco Advisors’ Broad MACS Composite.

These two rate-hike periods can be characterized by very distinctive market dynamics and macroeconomic conditions. For instance, the June 2004 through July 2006 hiking cycle saw higher absolute rate levels and more robust equity returns as markets recovered from the bursting of the tech bubble and a short recession at the beginning of the decade.

In that same vein, the Fed took very different approaches to raising rates during these two hiking cycles. During the hiking cycle of the early 2000s, the Fed sought to combat what it viewed as elevated inflation, as the 12-month seasonal adjusted CPI hit 3.6 percent in December 2004 and 3.3 percent in December 2005. At that time, like today, the Fed believed that inflation in 2004 was, in large part, a result of transitory factors, allowing a measured approach to rate-hikes. The Fed would raise rates 17 times in all but eight of the 25 total months during this stretch, with eight of those 17 rate-hikes occurring in 2005 alone.

By comparison, the pace of rate-hikes was slower during the second defined hiking cycle, with the Fed raising rates a total of eight times over the two-year span as the economy solidified its recovery from the 2008 financial crisis. Inflation was less of a concern during this second period, with seasonally adjusted CPI increasing 1.6 percent during 2016 heading into the rate-hike cycle. The Fed hiked rates during the second period less out of necessity to fight economic overheating, and more to reload the Fed’s ammunition in anticipation of future recessions.

MACS performed well on an absolute basis during the first defined hiking cycle because they benefited from strong returns in public equities (as defined by the MSCI ACWI) and commodities (as defined by the S&P Goldman Sachs Commodity Index), which compounded 15.29 percent and 14.33 percent, respectively, between June 2004 and July 2006. However, MACS generally struggled in 2017 and 2018. Commodities during the 2016–2018 period hampered returns, with the S&P Goldman Sachs Commodity Index returning -2.21 percent. Comparatively, global equities and global fixed income (as defined by the Bloomberg Global Aggregate Bond Index) returned 7.38 percent and 2.66 percent, respectively, over the same time period.

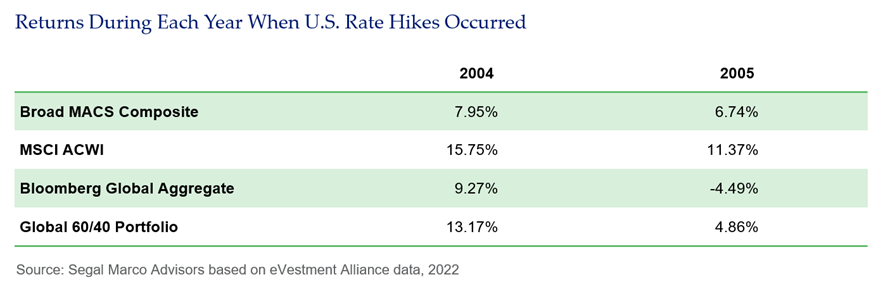

The following table looks at the first period of rate-hikes more closely on an annual basis.

The Fed raised short-term interest rates six times in 2004, with all hikes coming in the second half of the year. During that same year, MACS underperformed traditional asset classes, but held up well on an absolute basis.

The following year, 2005, the Fed continued to hike rates, with eight increases over the course of the year. MACS continued to hold up, outperforming a global 60/40 portfolio’s return by 188 basis points.

In 2006, MACS produced its strongest absolute returns of the entire rate-hike cycle, but underperformed the global 60/40. Delving a bit deeper on the dynamics of 2006 more specifically, prior to the Fed’s final rate-hike, MACS returns had held up well, but the underperformance relative to the global 60/40 came in the second half of the year following the conclusion of the Fed’s rate-hike cycle.

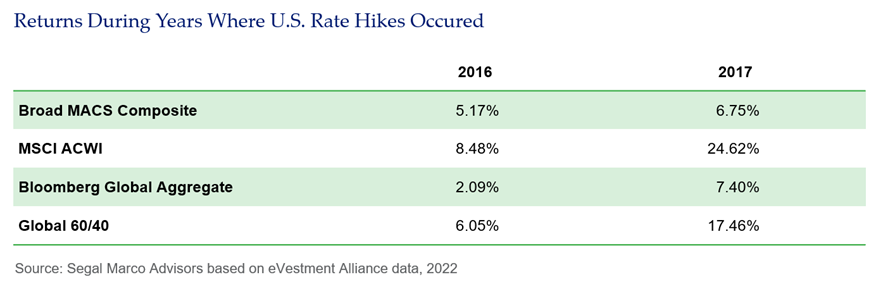

The following table considers the second rate-hike period on a year-by-year basis.

The Fed raised rates once in 2016, in December. However, it had increased rates once in 2015 and the anticipation of further hikes was largely being priced into markets prior to the hike itself. MACS captured much of the upside in 2016 before struggling to maintain that upside capture in 2017, largely due to the blowout performance of stocks in that period. More importantly MACS proved resilient during 2018, with the composite falling just 2.36 percent, compared to -5.70 percent for the global 60/40 and -8.93 percent for the MSCI ACWI. MACS tend to have reduced exposures to equities given the inherent diversified nature of these strategies, an attribute that hurt performance during periods of equity strength, as was generally seen during both aforementioned rate-hike cycles.

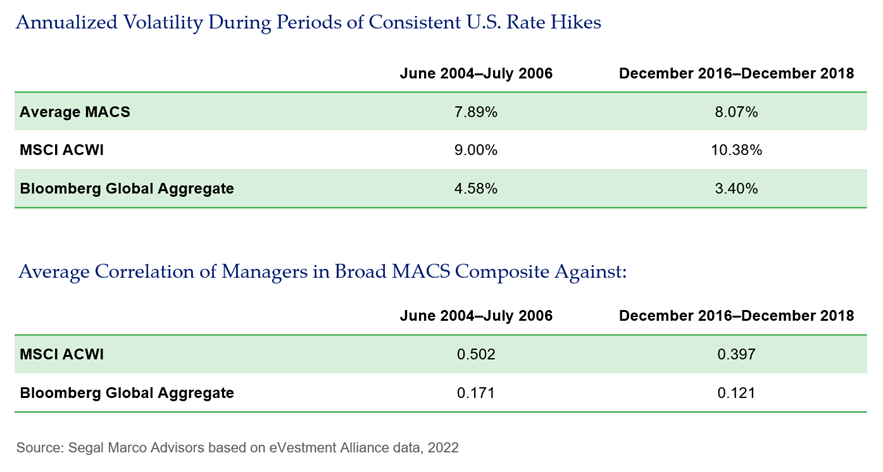

Volatility of MACS during rate-hike periods

The following two tables review of risk statistics during these two rate-hike cycles.

The average MACS manager has produced a lower volatility profile than that of global equities in these time periods. Allocating to multiple MACS managers to create a portfolio provides further risk benefits, with the Broad MACS Composite’s return stream producing a standard deviation of 4.64 percent and 4.08 percent over the two time periods, respectively. Although the more favorable volatility profiles of MACS managers did not appear to offer significant advantages when compared to those of public equities, their ability to maintain a level of consistency has appeared key during the current rate-hike cycle, as volatility has spiked significantly in public markets. Correlation dynamics between managers within the Broad MACS Composite and traditional market indices show the benefits an allocation to MACS would have offered during past rate-hike periods, with MACS remaining relatively uncorrelated against bond market returns and generally providing appealing diversification to a public equity allocation.

Lessons for today?

Fast forward to today and the current market environment is once again different than both prior rate-hike cycles, with the federal funds rate only recently being raised to a 1.50 percent-1.75 percent range.

Prior to the rate hike in June, the median member of the Federal Open Markets Committee expected the federal funds rate to be at 1.9 percent by the end of 2022, which suggested seven total hikes, assuming the Fed’s previous 25 basis points increments. The median projection now sits at 3.4 percent for the end of 2022 and close to 4 percent for the end of 2023. Assuming the Fed continues to raise rates in 75 basis-point increments, a minimum of two more rate hikes are necessary to approach the median projection by the end of the year. The increase in the size of recent rate hikes has been largely driven by the severity of inflation, however, and it is yet to be seen what impact recent Fed action will have, making it difficult to project the continued magnitude or rapidity of future Fed moves.

Public equity returns appear likely to remain more volatile and vulnerable to further correction on the back of sustained inflationary pressures and weakened market sentiment, while commodity markets trade higher amid global supply-chain issues and geopolitical conflict. MACS appear better positioned today compared to the 2017–2018 rate-hike cycle to dynamically navigate and potentially exploit the growing uncertainties of the current market environment. In other words, MACS offer investors improved performance potential during a period when the market suggests there may be fewer traditional sources of return premiums available other than perhaps longer term and less liquid private strategies. The diversified nature of MACS, which commonly underweight equities given inherent risk profiles, generally offer protection during periods of market weakness and/or dislocation.

This inherent underweight to equities has proven valuable in recent months as global equities have experienced a significant correction. MACS struggled at times during previous rate-hike periods as a result of this diversification, seeing as equities largely provided strong returns, compounding 15.3 percent and 7.4 percent during the 2004–2006 and 2017–2018 periods, respectively. The continued uncertainty surrounding public equity markets on the back of rising interest rates, sustained levels of inflation and continued geopolitical tensions makes a structural underweight to equities (and diversification more broadly) much more attractive moving forward.

What is more, to combat the considerable effects of rising rates and inflation on the global fixed income market, MACS maintain the ability to tactically allocate to asset classes and factors that are less sensitive to such market dynamics. Examples include hard assets, most notably commodities, and TIPS. MACS also afford investors flexibility by way of investment implementation through the use of derivative instruments (e.g., to reduce the duration of their fixed income exposures and thus mitigate the impact of rising rates and steadily increasing inflationary pressures).

Given the wide breadth of strategy types that are included under the MACS umbrella, the specific correlation dynamics realized in a portfolio are dependent on the mandate selected. Looking forward, strategies that are less correlated to traditional asset classes and seek to generate alpha through effective tactical asset allocation decision-making and/or alternative sources of risk premia are likely better suited for the current environment. Overall, Segal Marco continues to view MACS as a viable and effective investment option, particularly during the current environment of rising rates, persistent inflation and uncertainty.

See more insights

The Russian Delisting Dilemma: Red Herring, Nightmare or Both?

Double Trouble: Stocks and Bonds Are Down Together in 2022

The Debt Ceiling: What History Tells Us

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.