Articles | April 15, 2021

The Effect of Rising Rates and Longer Duration on Fixed Income Returns

Much media attention has been given recently to the swift rise in interest rates in the U.S., particularly at the back end of the yield curve (i.e. 10+ years). Now that the most recent $1.9 trillion stimulus bill has been signed into law, it is relatively easy to understand why interest rates have been on a steady march higher for the better part of the past six months. In light of the COVID-19 pandemic and resulting monetary and fiscal intervention of governments and central banks around the globe, interest rates continued to make all-time lows on a regular basis.

At its depth, the yield on the 10-year U.S. Treasury Bond touched 0.5 percent in early March 2020 and bounced around in a volatile manner from that point forward. Even prior to that point, investors had been re-evaluating the role of fixed income in their broadly diversified portfolios, and now with a yield to maturity of 0.5 percent, it was becoming clear fixed income simply could not play the same role in an asset allocation framework as it had 10 years ago (even two years ago for that matter).

However, actual returns in core fixed income markets of late have contradicted this sentiment, as the Bloomberg Barclays U.S. Aggregate Index (Agg) delivered a solid 7.5 percent return in 2020, 8.7 percent in 2019 and an annualized 5.3 percent over the last three years. Within the context of a 30-year bull market in bonds, the idea of rising interest rates, or at least the impact of rising interest rates on investors’ fixed income portfolios, was certainly not top of mind.

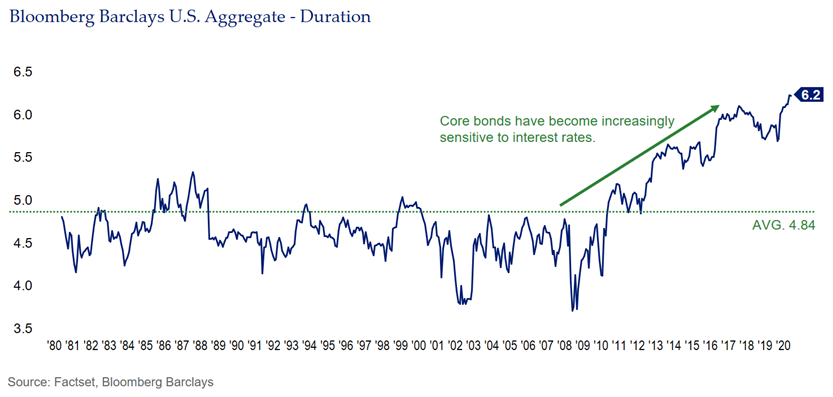

As rates continued to fall over the last 30 years, a dynamic was developing that has a material impact on the performance we’ve seen recently in fixed income markets —duration, which is a measure of the sensitivity of bond prices to changes in interest rates, was increasing. One very simplistic way to think about duration in the context of bonds is the amount of time it takes to recover your principal through the coupon payments the bond provides. If interest rates (and coupon payments) are lower, it takes longer to recover the same amount of money as it would with higher interest rates and coupon payments. The duration metric is meant to represent the resulting price impact on a 1 percent change in interest rates. In December 2008, the duration on the Agg was around 3.7 years. This meant that if interest rates rose 1 percent, you would expect a price return of -3.7%; pretty simple. Importantly, at that time the index was yielding around 4 percent, which meant even if rates rose 1 percent, the yield on the index would more than compensate for the price losses and protect investor capital. Fast forward 12 years to 2020 and the duration of the Agg sat at 6.2 years (almost double from 2008), while the index was yielding a mere 1.1 percent. As you can see, the yield on the index was dwarfed by the interest rate sensitivity and a 1 percent rise in rates would be expected to generate a -5.1% percent return on the index.

As mentioned earlier, the massive fiscal and monetary response to the COVID-19 induced economic recession effectively sowed the seeds for interest rates to climb higher. As more and more money was printed by the Treasury to plug the income gap created by the pandemic, concerns around inflation began to appear as more dollars were theoretically chasing a finite amount of goods and services (the supply of which was also dramatically impacted by the pandemic).

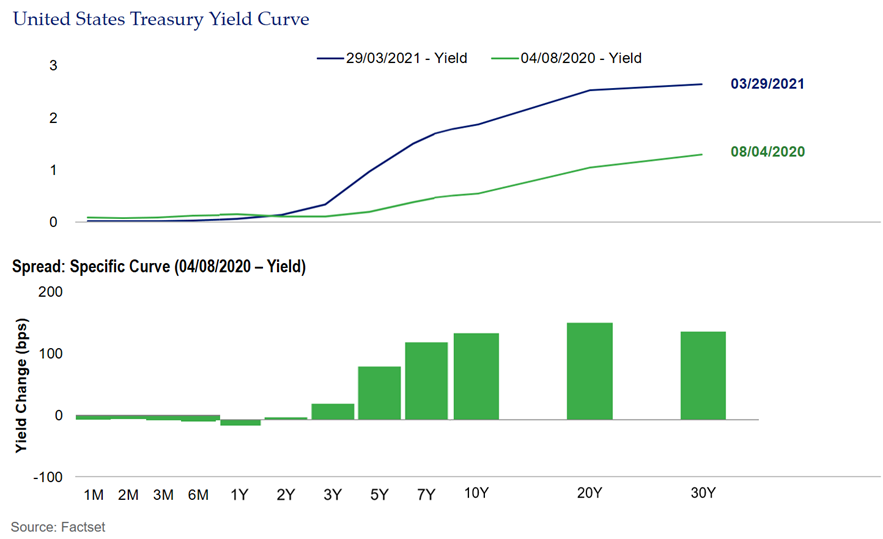

Bond investors hate inflation because it erodes the value of their fixed coupon payments, so we started to see upward pressure on yields, particularly in the longer end of the curve (10+ years) as bond investors were selling. Concomitantly, prospects for a massive economic recovery off of lows not seen since the Great Depression roused animal spirits in investors as many repositioned portfolios in riskier assets, such as equities, which benefit from economic growth. These combined forces have, thus far, resulted in a steady upward climb in rates. Since early August (through March 29, which is the date this was written), interest rates across the 10, 20, and 30 year portion of the yield curve (which carry the highest interest rate sensitivity) have all increased over one percent.

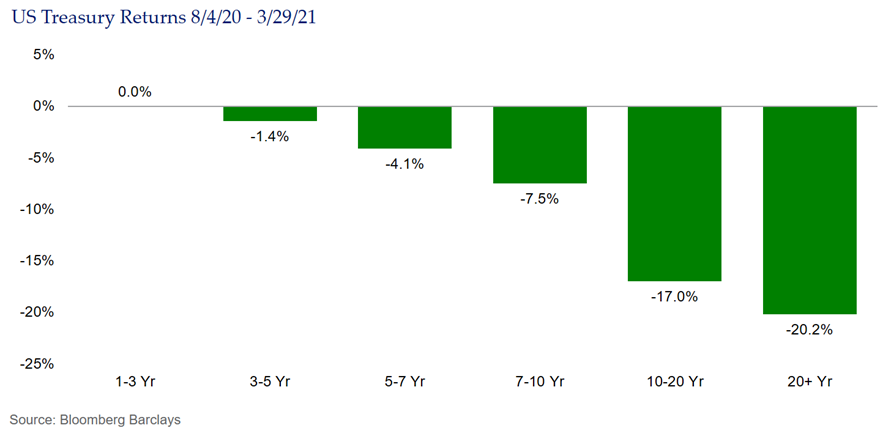

This swift repricing of interest rates has resulted in fixed income returns we have not seen in quite some time. Depending on at what point of the curve fixed income investors’ exposure lies, some returns are materially negative over that period. In particular, institutional investors who have implemented “LDI” (liability-driven investment) programs, which are designed to reduce the volatility associated with longer-duration liabilities through investing in long-duration fixed income, may have seen significant declines in their asset portfolios. Below, we illustrate the impact on performance caused by changes in interest rates across various tenors of the yield curve.

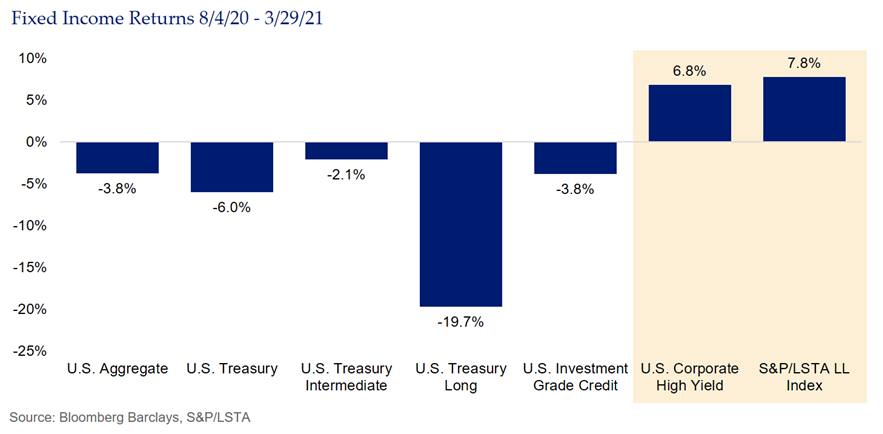

We have long been concerned about the yield/duration ratio inherent in many areas of the fixed income market, particularly in longer-duration Treasuries. Because of this, we sought the added diversification and yield enhancement offered in other areas of the fixed income markets, particularly what are considered “non-core” opportunities such as high yield and bank loans. By comparison, the returns of those markets over the same time frame is illustrated below.

Equity Markets in 2018: Reflecting on a Volatile Year

Choose Wisely: Active Equity Management in a Pandemic Meltdown

How Might Quantitative Tightening Affect Markets?

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.