Articles | August 11, 2025

U.S. Economy Posts Strong Second Quarter Results

What to make of GDP growth in Q2 2025?

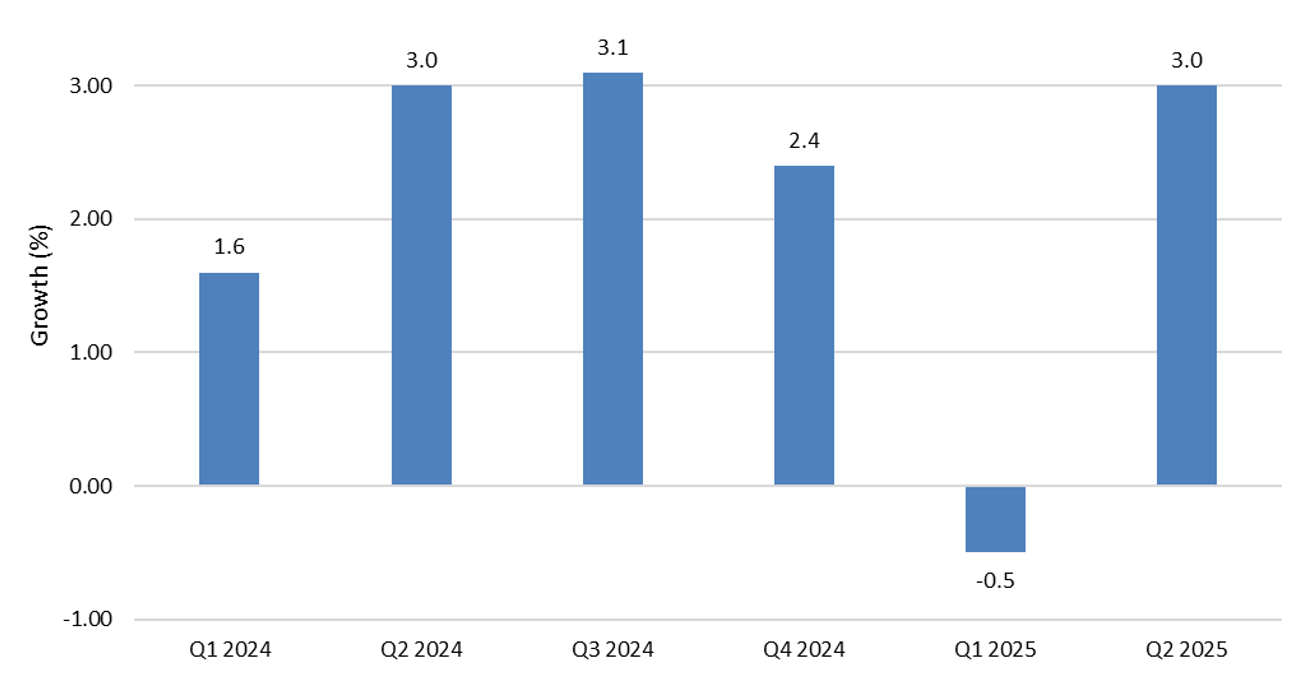

The brief answer is not much. Data is mixed and it’s still hard to gauge a trend line for the year. With the backdrop of macro uncertainty today’s GDP print was better than expected, with GDP posting a 3 percent annualized growth rate.

This was a notable improvement from Q1, when the economy contracted 0.5 percent. Additionally, consumer spending was up modestly at 1.4 percent, along with a general positive jobs picture and unemployment relatively low at 4.1 percent. Thus, with the economy displaying resilience within an ever-changing tariff environment and inflation holding steady above the 2 percent target, the Fed remained in restrictive mode and decided at today’s meeting to keep its benchmark rate at 4.25-4.50 percent.

Quarterly GDP 2024-YTD 2025

Source: Factset

However, it is worth noting that the strong Q2 results can be somewhat misleading, as the decrease in imports from ongoing tariff actions was a main contributor to boosting GDP. There are also some growing signals that in the face of continued trade and economic uncertainties, businesses are slowing investment. Consumer outlook and confidence appears to be moderating which will impact spending. Additionally, residential investment, in the form of home building and sales, declined for the second straight quarter. So, while the Fed paused a rate cut for now and did not clearly display its cards regarding a possible reduction at their next meeting in September, it is reasonable to assume that if economic headwinds and downside risks continue to develop in the second half of the year, the possibility of a monetary policy change increases.

See more insights

May 2025 Financial Markets

Trump Tariffs 2.0000000? (Sequel?)

June 2025 Financial Markets

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.