With the United Nations Climate Change Conference (COP26) recently wrapping up its efforts to draw conclusive action on tackling carbon emissions, there is a renewed focus on infrastructure’s role in achieving these goals. Countries, companies and organizations around the world are pledging to reach net-zero carbon emissions by 2050, which would help keep the planet’s temperature under control.

According to the Intergovernmental Panel on Climate Change (IPCC), a move to net-zero carbon emissions would limit the world’s temperature increase to 1.5 degrees, the tipping point after which many ecosystems become unsustainable. According to the IPCC, rapid change is required to reach this target.

The Paris Agreement, adopted in December 2015, is a legally binding global agreement on cutting greenhouse gas emissions that are causing global warming. The agreement was adopted by 196 countries and went into effect in November 2016 with the intent to review progress after five years. COP26 was the follow-up meeting from The Paris Climate Conference (COP21). One of its main aims was to push countries to impose more ambitious 2030 goals ahead of the 2050 net-zero target. Currently, more than 130 countries have committed to reaching net-zero carbon emissions by the 2050 deadline.

The role of infrastructure

Infrastructure plays a significant role in the move to decarbonize or reach net-zero carbon emissions, with many of the targeted initiatives falling under its remit. Essentially, the commitment to net-zero emissions requires countries to accelerate the phasing out of fossil fuels, increase investment in renewable energy and hasten the switch from gas and diesel vehicles to electric vehicles, as well as commit to other initiatives around sustainable farming and deforestation.

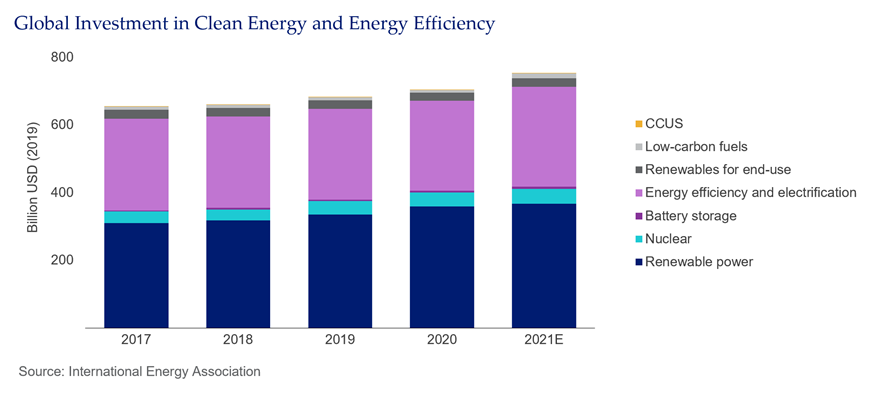

Decarbonization has a twofold impact on the infrastructure sector. First, as owners and operators of infrastructure assets, particularly in the energy and transportation sectors, general partners (GPs) can play a key role in helping to reduce global emissions. Second, the move to net-zero creates significant investment opportunities across the risk-return spectrum, whether it incorporates increased investment in renewable energy such as wind or solar (more core/core plus type investments), new technological advancements in energy transition (value add) and electric mobility (core plus/value add) or energy storage (core plus/value add). According to the International Energy Agency (IEA) an estimated $100 trillion plus will be required over the next three decades to reach net-zero carbon emissions by 2050.

Adoption of environmental and sustainability initiatives

Many infrastructure GPs are embracing the role that they can play in promoting decarbonization and operating their businesses and assets more sustainably. One could argue that it is in their best interest to do so, given that the increased opportunity set, the push from investors and requirements from regulators and policymakers all make it clear that greater commitment from infrastructure owners and operators to reduce carbon emissions is a welcome development.

In the last couple of years, we have seen a significant step-up by infrastructure managers in either hiring or dedicating senior level personnel to focus on ESG. We have seen greater adoption of environmental and sustainability policies and practices and lastly, we have seen more detailed reporting on the impact of these policies and initiatives.

Three such formal investor initiatives that are gaining industry traction are:

- UN Principles of Responsible Investments (PRI) — Signatories to the UN PRI demonstrate a commitment to responsible and sustainable investing.

- UN Sustainable Development Goals (SDG) — Infrastructure can play a key role in meeting the UN’s SDGs. In particular, SDG6 (clean water and sanitation), SDG7 (affordable and clean energy), SDG9 (building resilient infrastructure, promoting inclusive and sustainable industrializations and fostering innovation) and SDG13 (climate action).

- GRESB — This organization provides ESG data. Its Infrastructure Fund Assessment helps benchmark infrastructure funds.

COP26 will likely result in increased focus on the role infrastructure managers can play in reducing carbon emissions. As governments, businesses and other organizations step up their efforts to reach net zero in the wake of COP26, it is likely that investors, particularly public plans, will place more importance on ESG when making investment decisions. This is clearly evident in Europe.

Additionally, a GP’s experience and track record in and commitment to sustainability may also play an increasing role in the awarding of public and other contracts. As such, those managers for which this is already a core mission or focus area will be at an advantage while those slow to take action could quite easily be left behind.

Opportunities in decarbonization

The move towards net-zero carbon emissions has broadened the opportunity set for infrastructure investors. Key areas of opportunity include the production of different forms of renewable and low-carbon energy as well as the infrastructure and technologies required to support their penetration, adoption and efficiency.

While estimates vary, the global investment required to reach net-zero CO2 emissions by 2050 ranges between a massive $4.5 trillion and $5.8 trillion annually. Much of that spending will be focused on renewables, electrification, energy efficiency and supporting infrastructure.

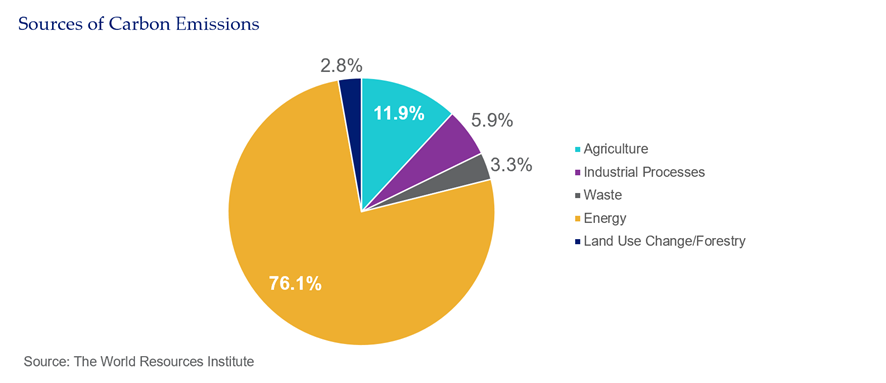

The energy and transportation sectors are two of the largest contributors to CO2 emissions. As such, their decarbonization will have the most significant impact on achieving the net-zero target by 2050. As of year-end 2018 (the most recent data available), the energy sector was responsible for 76 percent of all global carbon emissions with transportation accounting for approximately one third of that, according to the World Resources Institute.

Renewable energy

Energy transition refers to the global shift from reliance on fossil-based fuels, such as oil, natural gas and coal for energy production and consumption to environmentally friendly renewable energy substitutes, such as wind, solar, hydropower, bioenergy, geothermal and marine energy.

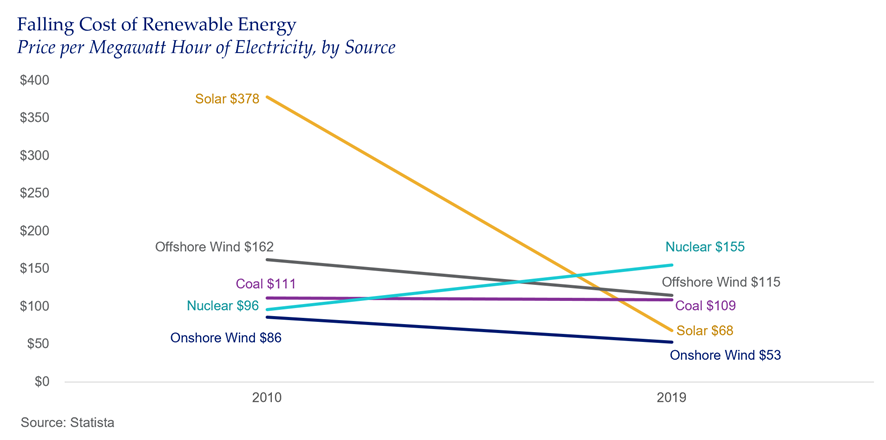

Governments are actively pushing investment in renewable energy sources. By year-end 2021, the IEA expects renewables to represent 30 percent of electricity generation worldwide. Declining costs of solar and wind energy have helped fuel the growth of this sector, with prices now below those of many traditional fossil fuels. Prices should continue to decline due to more widespread acceptance, improved technologies and increased pressure from various stakeholders.

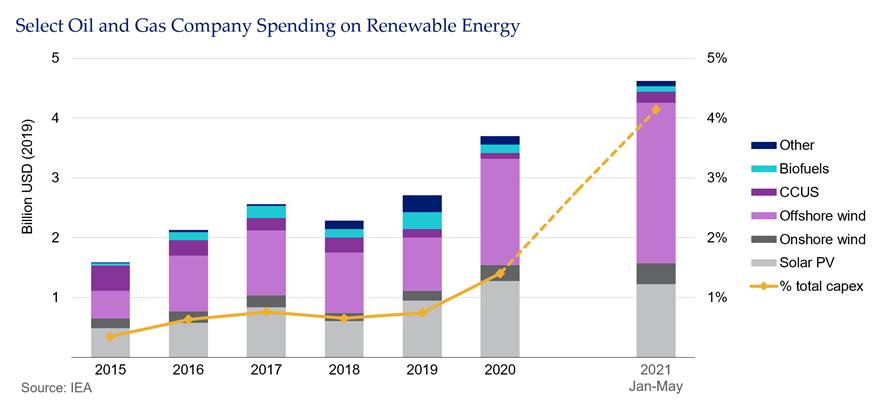

The energy transition is well on its way. Annual investment into new renewable power has grown from less than $50 billion in 2004 to $500 billion in 2020, according to a January 19, 2021 Bloomberg article, “Spending on Global Energy Transition Hits Record $500 Billion.” Utilities are swiftly shifting away from coal. A number of the big oil and gas companies, such as Royal Dutch Shell, Total, BP, Eni and Equinor, are expanding into renewable energy and/or have set net-zero emissions targets. Some of the more popular strategies pursued by these companies include increasing their investments in wind and solar, expanding into green hydrogen or going the carbon-capture route to clean up existing fossil-based production. While investment in renewable energy has more than doubled since 2019, it still only represented just over 4 percent of total capex spending for the first six months of the year.

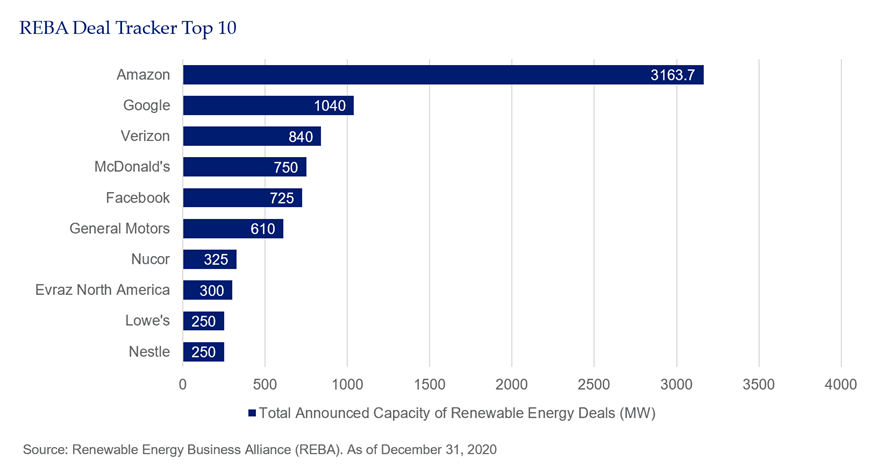

Businesses and other organizations are also increasingly striving to procure more of their energy needs from renewable sources. Amazon is the largest corporate buyer of renewable energy in the world, with over 230 renewable energy projects globally that combined have approximately 10 gigawatts of production capacity (enough to supply 2.5 million homes). The company is on track to run on 100 percent renewable energy by 2025, five years ahead of its 2030 target, as reported in PV Magazine’s article “Top 10 U.S. Corporate Renewable Energy Buyers of 2020.” Top buyers of renewable energy also include other technology-based firms such as Google, Facebook and Apple, which all have high energy requirements given their extensive data center holdings. Companies in other sectors are also upping their game and increasing their reliance on renewable energy.

The following chart highlights the top 10 acquirers of renewable energy in 2020.

To date, investment in renewable power has focused primarily on solar and wind, which accounted for 46 percent and 29 percent, respectively, of global renewable energy investment between 2013 and 2018, the International Renewable Energy Agency reported. And, while these sectors are expected to continue to dominate, investment is required across all sectors in order to reach the net-zero goal by 2050. According to the IEA, by 2050, approximately 90 percent of electricity generation will need to come from renewable sources, with wind and solar expected to account for 70 percent of that. This will require massive investment in renewable energy on a global scale.

Electric transportation

The transportation sector represents approximately one-third of global energy demand. Currently, there has been very limited penetration by renewable energy, and the sector remains very much dominated by fossil fuels. As such, there is significant potential for change and the sector is a key focus area for governments.

Decarbonizing transportation plays a critical role in reducing carbon emissions. According to the IEA, the transportation sector is responsible for 24 percent of global emissions, with almost 75 percent attributed to cars, trucks, buses and two- and three-wheelers. Opportunities to decarbonize the sector include switching to lower-carbon fuels, improving vehicle efficiency and improving facilities for multi-passenger transportation, like light rail.

Electrification, powered by renewable energy, is a key growth area for rail and light-duty road transport (i.e., cars, SUVs and small trucks). However, it is not a viable option for long-haul, heavy duty modes of transportation such as road freight, aviation and shipping. One possible option here would be green hydrogen; however, this is not currently a cost-effective option. Green hydrogen currently only represents less than 1 percent of all hydrogen supplied, largely due to the high costs and complexities associated with its use. Currently, it costs four times more to make green hydrogen than grey hydrogen (where electrolyzers are powered by fossil fuels and natural gas), according to a Reuters article, “Industrial Companies Boost Target for Green Hydrogen in Climate Fight.” Many countries are offering subsidies to help lower production costs. The belief is that costs will fall over time and this energy source will become a lot more competitive.

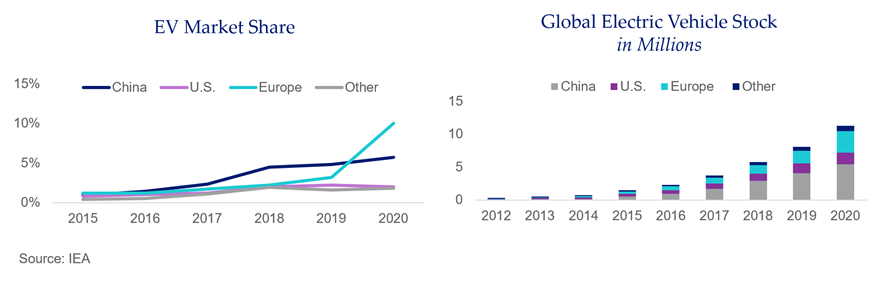

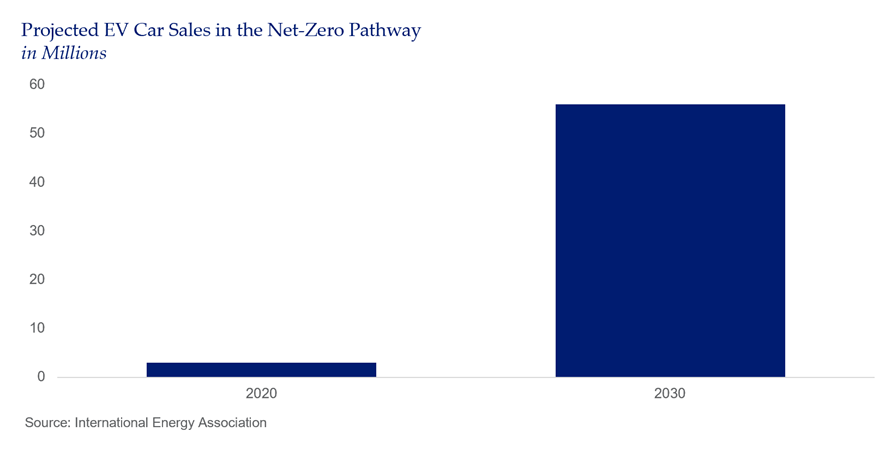

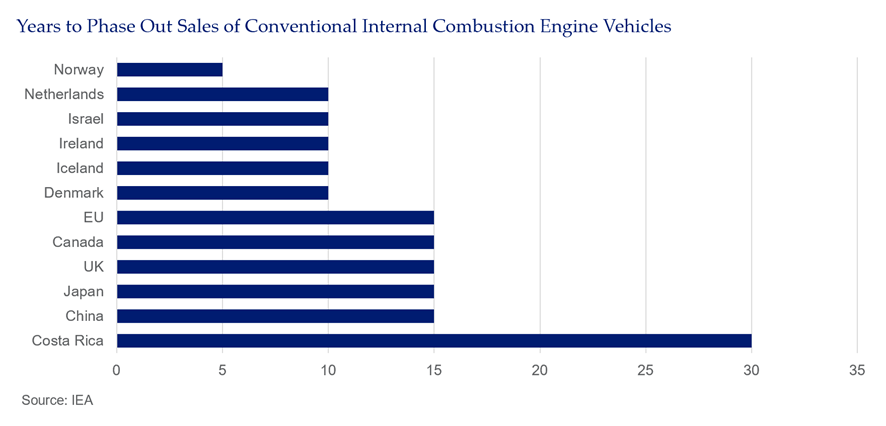

Although the global electric vehicle (EV) market share is currently a relatively modest 4.6 percent, the market is experiencing exponential growth with registrations increasing by 41 percent in 2020, at a time when total car sales contracted by 16 percent, according to the IEA’s Global EV Outlook 2021. In the last year, Europe forged ahead of China in terms of adoption of EVs, with a 10 percent market share. Adoption is expected to gain even more momentum as technologies improve, costs decrease, supporting infrastructure improves and countries pledge to phase out traditional vehicles. At COP26, leading automakers as well as over 20 countries agreed to make 2035 the year at which all new car sales would be EVs.

The switch from gas and diesel-fueled vehicles to EVs provides a significant investment opportunity in terms of providing electric charging stations, battery storage and improvements to the electric grid in order to support increased demand. While the U.S. did not agree to meeting the 2035 target at COP26, it is nonetheless committed to supporting the adoption of EVs. The Infrastructure Investment and Jobs Act that President Biden recently signed into law calls for $7.5 billion to build a national network of charging stations.

Supporting technologies and infrastructure

Massive investment in technologies and infrastructure is needed to support the penetration and adoption of renewable energy. According to the IEA, by 2050, almost half the reductions in emissions will come from technologies that are currently in either prototype or demonstration phase. Significant headway has already been made in certain technologies and supporting infrastructure, such as battery storage and distributed generation.

Battery storage

Battery storage is one technology that can support the growth and expansion of renewable power. Investment in battery storage increased by just under 40 percent to $5.4 billion in 2020, bringing the cumulative amount spent to $22 billion, according to Wood Mackenzie: “Americas to Lead Global Energy Storage Markets by 2025.”

Significant advancements have already been made in battery storage for EVs. Increased demand for battery storage driven by rapid adoption of EVs has resulted in manufacturing economies of scale, driving costs lower. Simultaneously, advancements in technology have resulted in better performance. For instance, lithium-ion batteries, which are used by most EV car makers, experienced an 80 percent price decrease from 2010 to 2017, according to “Supercharged: Challenges and Opportunities in Global Battery Storage Markets" by the Deloitte Center for Energy Solutions.

The ability to store energy will play a critical role in allowing for greater dependency on and deeper penetration of renewable energy. Wind and solar power by their nature can be irregular and can alternate between periods of high and low productivity. Increased investment in battery storage technology is needed to keep electricity grids’ supply and demand in balance. Grid modernizations and the transition to smart grids further fuel the need for battery storage solutions. The push towards renewable energy will accelerate investment in battery storage, which is expected to reach $86 billion by 2025, according to Wood Mackenzie. More widespread use and improving technologies, such as artificial intelligence, blockchain and predictive analytics, should help reduce costs even further.

Distributed energy

Solar, and wind to a lesser extent, are playing a critical role in companies and other organizations reducing their reliance on energy generated from fossil fuels. Distributed generation (DG, also called on-site generation or decentralized generation), in particular, is playing a key role in the growing acceptance of renewable energy as a cost-efficient viable substitute for electricity produced from fossil fuels. Distributed generation is defined as energy produced close to the point of consumption. As such, it does not need to be transported over the electric grid, but may use microgrids (small, self-contained electric grids) instead. DG systems, using solar photovoltaic panels, dominate across residential, commercial and other consumers. Advancements in new technologies have resulted in solar panels that are smaller, more effective and easier to install, making it an attractive option for consumers. However, other forms of renewable energy are also used by industry, commerce or other organizations including small wind turbines, natural-gas fired fuel cells, municipal solid waste incineration and biomass combustion.

Regardless of energy source, it is clear that DG will continue to play a critical role in the penetration of renewable energy with over $846 billion expected to be invested over the next decade, according to Frost & Sullivan’s “Growth Opportunities in Distributed Energy, Forecast 2030.”

EV charging infrastructure

As the penetration and adoption of EVs continues its rapid ascent, significant investment is required in the supporting infrastructure, such as charging stations and grid enhancements. With many governments recently pledging to hasten the phase-out of conventional internal combustion engines, massive investment in charging station infrastructure will be required to support more widespread adoption. According to Schroders, in order to facilitate the growing adoption of EVs, an annual run-rate of $80 billion needs to be invested in charging infrastructure over the next 20 years.

Many different stakeholders will lead the future push toward net zero

In summary, there is no doubt that the push for decarbonization will create investment opportunities, while also benefiting the environment. Increased focus by governments is fueling rapid investment in green energy and energy transition.

But it is not only governments that are driving this change — private enterprise has also entered the game, publicly committing to reach net-zero emissions. For example, more than 200 global organizations have signed Amazon’s Climate Pledge to reach net-zero carbon emissions by 2040.

Increased pressure and urgency from governments, investors, stakeholders, activists and customers will keep the focus on decarbonization and accelerate the push towards sustainability, which will require significant capital investment in existing infrastructure as well as in developing new plants and technologies.

See Related Insights

Breaking down the U.S. Equity Market: Six Versus 494

Choose Wisely: Active Equity Management in a Pandemic Meltdown

Segal Marco’s Survey of Investment Managers on Internal ESG Policies

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.