Markets were volatile during the month, with declines driven by concerns over high-tech valuations, followed by a rebound with the end of the government shutdown. U.S. equity market valuations are at historic highs, with both trailing and forward P/E ratios ahead of longer-term averages. Market headlines continue to be focused on technology sector concentration, AI debt needs and Bitcoin sell-off.

| Equity | YTD (%) | MTD (%) |

|---|---|---|

| All Cap U.S. Stocks |

|

|

| Russell 3000 | 17.2 | 0.3 |

| Growth | 18.8 | -1.7 |

| Value | 15.0 | 2.7 |

| Large Cap U.S. Stocks |

|

|

| S&P 500® | 17.8 | 0.2 |

|

Russell 1000 |

17.4 | 0.2 |

| Growth | 19.3 | -1.8 |

| Value | 15.1 | 2.7 |

|

Mid Cap U.S. Stocks |

|

|

|

S&P 400 |

7.4 | 2.0 |

|

Russell Midcap |

10.9 | 1.3 |

| Growth | 10.1 | -2.1 |

| Value | 11 | 2.4 |

| Small Cap U.S. Stocks |

|

|

| S&P 600 | 6.1 | 2.7 |

| Russell 2000 | 13.5 | 1.0 |

| Growth | 14.5 | -0.7 |

| Value | 12.4 | 2.8 |

| International |

|

|

| MSCI EAFE NR (USD) | 27.4 | 0.6 |

| MSCI EAFE NR (LOC) | 18.1 | 0.6 |

| MSCI EM NR (USD) | 29.7 | -2.4 |

| MSCI EM NR (LOC) | 27.9 | -1.6 |

| Fixed Income | YTD (%) | MTD (%) |

|---|---|---|

| Bloomberg |

|

|

| U.S. Aggregate | 7.5 | 0.6 |

| U.S. Treasury: 1-3 Year | 4.8 | 0.5 |

| U.S. Treasury | 6.7 | 0.6 |

| U.S. Treasury Long | 7.4 | 0.4 |

| U.S. TIPS | 7.4 | 0.2 |

| U.S. Credit: 1-3 Year | 5.4 | 0.5 |

| U.S. Intermediate Credit | 7.7 | 0.7 |

| U.S. Credit | 8.0 | 0.6 |

| U.S. Intermediate G/C | 6.9 | 0.7 |

| U.S. Govt/Credit | 7.2 | 0.6 |

| U.S. Govt/Credit Long | 8.1 | 0.4 |

| U.S. MBS | 8.4 | 0.6 |

| U.S. Corp High Yield | 8.0 | 0.6 |

| Global Aggregate (USD) | 7.9 | 0.2 |

| Emerging Markets (USD) | 10.6 | 0.2 |

| Morningstar/LSTA |

|

|

| Leveraged Loan | 5.2 | 0.3 |

| Alternatives | YTD (%) | MTD (%) |

|---|---|---|

| Bloomberg Commodity | 16.1 | 3.2 |

| S&P GSCI | 7.4 | -0.1 |

Source: Segal Marco Advisors

The S&P indices are a product of S&P Dow Jones Indices, LLC and/or its affiliates (collectively, “S&P Dow Jones”) and has been licensed for use by Segal Marco Advisors. ©2025 S&P Dow Jones Indices, LLC a division of S&P Global Inc. and/or its affiliates. All rights reserved. Please see www.spdji.com for additional information about trademarks and limitations of liability.

Macroeconomics

While the official CPI report for November will not be released until mid-December, a FactSet consensus survey of economists expects inflation to remain relatively steady (and sticky) with a modest increase of 0.2 percent forecasted for the month. The Producer Price Index (PPI) for September increased by 0.3 percent for the month, which followed a small decline in August.

A delayed BLS report about employment in September featured a better-than-expected 119,000 jobs added. The unemployment rate rose a notch to 4.4 percent, with some large employers announcing layoffs.

The ISM Manufacturing PMI survey results decreased by 5 basis points to 48.2 in November, with the overall negative trend continuing in lower inventories, new orders and higher prices. The Conference Board Consumer Confidence Index survey fell nearly seven points in November to 88.7, over reduced sentiments regarding jobs, incomes and financial situations.

Equity markets

U.S. equities had a seventh consecutive month of positive returns with the S&P 500 up 0.3 percent. On a sector basis, Healthcare (+9.3 percent) was the top contributor, with Information Technology (-4.3 percent) the weakest. Russell Midcap (+1.3 percent) outpaced Russell 2000 small-cap stocks (+1.0) and Russell 1000 large stocks (+0.2 percent). Russell 3000 all-cap value index (+2.7 percent) outperformed Russell 3000 all-cap growth index (-1.7 percent) during the month.

The positive month masked mid-month volatility as technology stock valuations triggered a decline of 5.7 percent from the S&P 500 historic high reached in October and increased volatility, as the VIX also hit its highest level since April’s tariff-driven spike. However, by month-end that decline was erased.

International equity markets were mixed, with developed regions (EAFE +0.6 percent) ahead of emerging regions (EM -2.4 percent). Europe (1.5 percent) led developed markets, while Latin America (6.1 percent) led in emerging. International markets have outperformed the US S&P 500 (17.8 percent) year to date; helped by the weakened U.S. dollar as the MSCI EM (29.7 percent) was ahead of the MSCI EM Local Currency (+27.9 percent) and the MSCI EAFE (27.4 percent) was significantly ahead of the MSCI EAFE Local Currency (+18.1 percent).

Fixed income markets

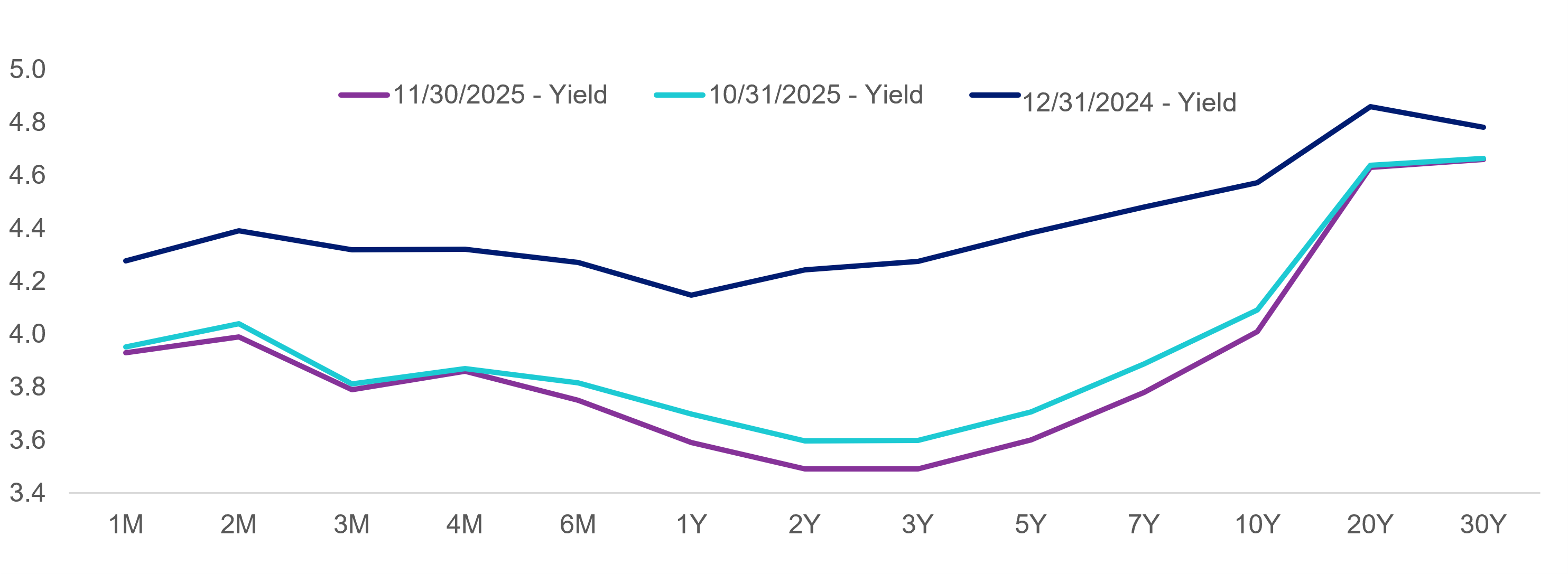

Fixed income markets were positive, with the Bloomberg U.S. Aggregate Index up 0.6 percent. The U.S. Treasury yield curve steepened, as yields mostly declined month-on-month with the largest decline of 11 bps in the 1–7-year maturities. Investment-grade corporates, high yield and asset-backed securities spread levels remained tight during the month.

U.S. Treasury Yield Curve

Source: Factset

Looking ahead

The near-term outlook is mixed. Optimism is fueled by a potential interest rate cut, ongoing AI investment gains and anticipated strong corporate earnings as the economy rebounds post-government shutdown. However, there is also caution given high market valuations, persistent inflation and potential volatility from geopolitical situations. The Federal Reserve’s decision at their next meeting on December 10 will be made against a backdrop of divergent policy views and lagged economic data. A widely anticipated cut, if enacted, will provide both forward guidance on 2026 rates and be a pivotal factor in sustaining market momentum.

See more insights

Looking Down the Barrel of a Government Shutdown

August 2025 Financial Markets

September 2025 Financial Markets

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.