At yesterday’s December Federal Open Market Committee (FOMC) meeting, the central bank voted 9-3 to cut the federal funds rate for a third time this year by 25 bps to a range of 3.5-3.75 percent. In rendering its decision, the board remained focused on their dual mandates of price stability by lowering inflation to a 2 percent target and supporting the economy’s path to full employment.

Currently, as was the case at their October meeting, the Fed opted to focus on the softening labor market conditions as the dominant economic concern influencing the call to further ease rates. However, as the vote indicates, the committee was divided, with individual policymakers maintaining different perspectives regarding the strength of the economy and comparative inflation and employment risks.

Due to the government shutdown that ended in November, the economic data that the Fed typically utilizes in policy decisions has been unavailable or released with a two-month lag. For example, the Personal Consumption Expenditure index (PCE) — the Fed’s preferred inflation measure — is from September, and on a core basis indicated a 2.8 percent increase on an annual basis, down .1 percent from August. Comments from Chairman Powell suggest that although the inflation level remains sticky, the economy has made progress on non-tariff inflation and the outlook regarding tariffs is for a continued cooling as pressures from one-time goods price increases are likely to be transitory and recede after peaking in Q1 2026. However, on the labor front, the majority of the board view conditions as having more downside risks. The unemployment rate of 4.4 percent may tick up another one or two tenths of a percentage point as more current data is received, according to Powell. The recently released BLS September and October Job Openings & Labor Turnover Survey (JOLTS), which tracks labor demand, reflects a softening market. The new “hires” rate backtracked in October to match a previous cycle low. Although the “quit rate” has slid downward, observers believe this suggests workers are not being recruited as actively from other firms and remain cautious about seeking other job opportunities. Additionally, the Fed’s Beige Book revealed that in the first two weeks of November, layoffs rose, employers implemented hiring freezes and worker hours were adjusted. Thus, the primary impetus for the FOMC majority’s dovish policy was a perceived deterioration in the labor market.

The markets, which had been anticipating a rate cut at the meeting, reacted positively to the official announcement. At the close of yesterday’s trading, equity indices had gained, with the Dow up 1.1 percent, the S&P 500 0.7 percent and NASDAQ 0.3 percent. At the shorter end of the Treasury curve yields were down at about 7-8 bps, with the longer end also declining (but less so) at 2 bps, likely due to ongoing inflation concerns. Some of the bullish market sentiment may also have been stoked by the Fed announcing it will begin buying $40 billion of Treasury bills per month starting on December 12, as it attempts to rebuild reserves in the financial system.

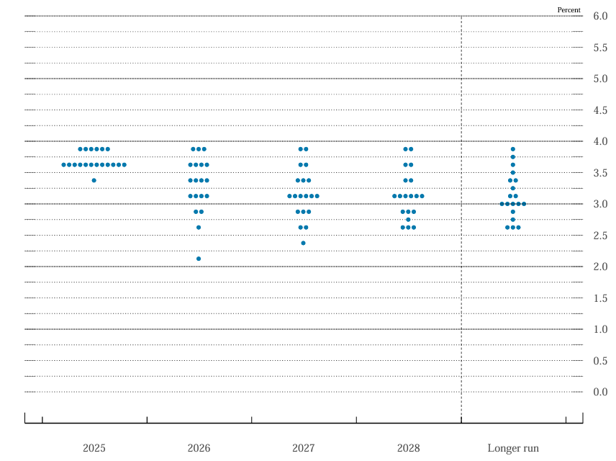

As for forward rate guidance, the Fed’s “dot plot” or projection for the funds rate at the end of 2026 shows a consensus median estimate of one 25 bps cut to 3.4 percent. However, there is a wide divergence of policy sentiments, as the distribution indicates four policymakers expect no rate cut, three foresee a hike, and twelve anticipate at least one rate cut ranging from 25 to 50 bps or below 3 percent in the benchmark rate by the end of next year. The full range of opinions run from expectation of higher rates to more aggressive easing.

Federal Reserve Dot Plot

Source: Federal Reserve

The rate decision reached yesterday was not only made amidst a divergent board, but also a transitional one. As Chairman Powell will be stepping down in May, the question as to who will succeed him looms large. Given that the current administration has been vocal in advocating for deeper rate cuts, there are concerns that the new Chairman appointment may usher in a period of increased politization and threaten the traditional independence of the Fed. Neither outcome would likely be warmly embraced by the markets, but we will cross that bridge when we come to it. Stay tuned.

See more insights

November 2025 Financial Markets

The Sun Rises on the Government Shutdown

October 2025 Financial Markets

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.