Articles | September 23, 2021

Why Passive Investing in Equity and Fixed Income Asset Classes Differs

By Don Sheridan

Since 2000, passive investing has grown significantly in terms of total assets under management primarily due to attractive fees, exposure to a desired beta and retail investor appetite. The availability and number of passive strategy offerings skyrocketed with the Exchange Traded Fund (ETF) revolution, which saw exponential growth from 102 funds in 2002 to over 8,000 today. This trend is occurring in both equity and fixed income asset classes, but fixed income is lagging in adoption.

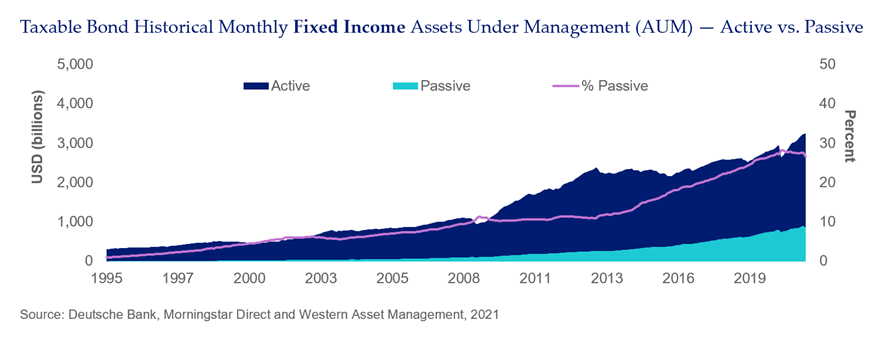

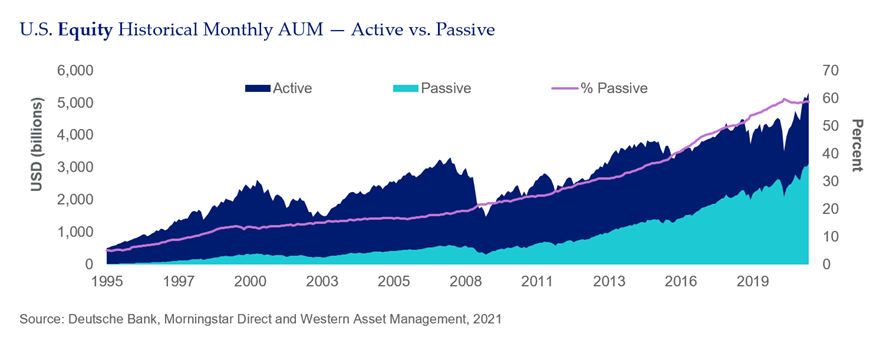

The following charts illustrate this growth trajectory. Passive fixed income hovers around 30 percent of taxable bond assets under management, while passive equity representation is closer to 60 percent.

What’s behind this difference in adoption

Equities are traded throughout the day through a centralized exchange, like the NYSE or Nasdaq, while bonds are over-the-counter instruments that trade much less frequently, making it difficult for as precise a valuation as more fungible publicly-traded stocks. The more liquid nature of equities has allowed for a wide range of niche and specific equity ETFs that go well beyond plain-vanilla broad index investing, including pot stock ETFs like ETFMG Alternative Harvest (MJ), an obesity-focused ETF (SLIM) or the Video Game Tech ETF (GAMR).

For bonds, this challenge for price certainty creates inefficiencies that investors can capitalize on and source alpha through active management. Furthermore, bonds are issued in a variety of ways, with different structures and characteristics such as convexity, maturity, capital structure position, optionality and duration. Unlike public equities, no two bonds are the same, which can also create pricing inefficiencies and alpha opportunities.

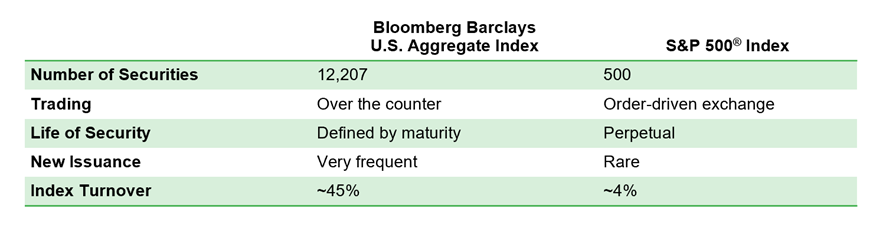

The most widely targeted U.S. equity and fixed income indices are the S&P 500® Index and the Bloomberg Barclays U.S. Aggregate Index. When comparing the two, it’s possible to drill down into the index methodology and see how much more complex it is for passive replication of the broad fixed income index compared to the large cap equity S&P 500® Index.

In addition to passive fixed income being more complex, with less pricing precision than equities, comparing the performance results of these two indices within their respective universes further erodes support for passive fixed income. When looking at active manager universe performance net of fees (as defined in Morningstar as the U.S. Large Blend for equities and the U.S. Intermediate Term Bond for fixed income) against these respective indices, the median fixed income manager outperforms the Bloomberg Barclays Aggregate Bond Index in all trailing periods.

As of February 28, 2021, the 5-year and 10-year trailing outperformance for the median fixed income manager was 91 bps and 64 bps, respectively. In contrast, the active U.S. equity managers have a much harder time against the S&P 500® Index. The underperformance on the equity side for the median manager over these two periods was -114 bps and -95 bps, respectively.

Historically, passive and active were seen as two separate and distinct strategic allocation decisions. Today, there’s greater utilization of passive instruments by institutional clients and some active managers are adding it to their toolkits. In active management, transferring risk temporarily to an ETF can be an efficient use of resources and a benefit to investors.

How can fixed income ETFs play a role in portfolios?

For institutional investors, ETFs can be a useful temporary tool for rebalancing, liquidity management, transition management and tactical adjustments. Fixed Income ETFs allow for immediate exposure to desired beta through the basket creation and redemption methodology that governs ETF vehicle structure. In such situations, using an ETF removes the need to source individual bonds or look to more complicated arrangements through derivatives and swaps.

Mitigating costs and complexity is a reason for both investors and money managers to consider ETFs as tactical, short-term solutions. However, the data and history of passive management in the fixed-income asset class does not support a strategic allocation to best use capital and address most institutional clients’ long-term investment goals.

See more insights

Aging Defined Benefit Pension Plans and the Challenges They Face

Did Big Ben Answer the Question?

The Death of Bowley’s Law and the Labor Share of Output

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.